From the blog...

Bank of Canada Update: What It Means for Ottawa Real Estate

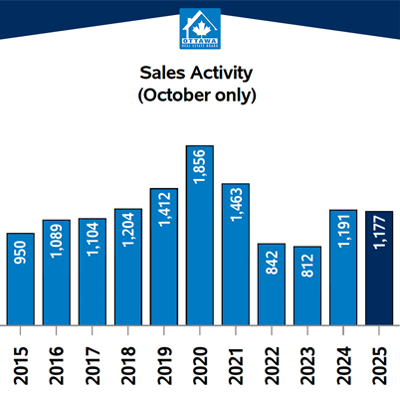

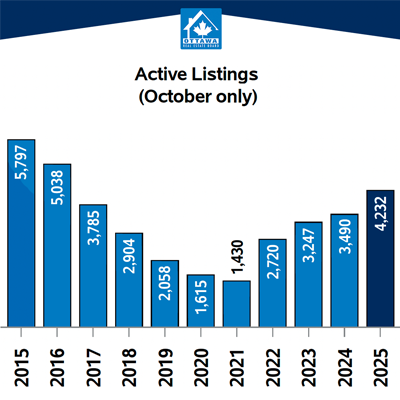

There’s some real opportunity out there right now in the Ottawa real estate market. We’re seeing sellers making big price adjustments, and that’s creating some great buys — even a few that could make sense for investors or anyone looking to renovate and resell. It’s been years since we’ve seen that kind of window open in Ottawa, and it’s refreshing to see balance returning.

The recent interest rate cut from the Bank of Canada — down another quarter of a percent — has given the market a boost of optimism. It wasn’t guaranteed (most thought it was a coin toss), but it happened, and it’s good news. Variable mortgage holders are already seeing the benefit, and for anyone renewing in 2025, it may open up more flexible options between fixed and variable rates.

When you look at the bigger picture, we’ve had 1.75% in rate cuts since June 2024. That’s a major shift that helps with affordability and confidence. The next Bank of Canada announcement is coming up on December 10th, and all signs are pointing toward continued easing.

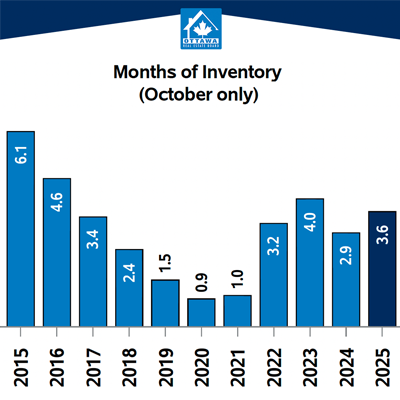

That said, the market is behaving differently depending on where you are. In Ottawa’s outer areas — places like Carleton Place, Embrun, and the surrounding small towns — listings are sitting a little longer. There’s just more inventory out there right now, so even homes that are priced well and staged beautifully are taking more time to sell. The condo market’s seeing a similar trend: you can have the perfect unit in the right neighbourhood at a great price, and it might still take a while to find the right buyer.

Overall though, this shift is healthy. Buyers have more breathing room, sellers are pricing more realistically, and we’re moving toward a more balanced Ottawa real estate market — something we haven’t had in a long time.

If you’re thinking about buying, selling, or just want to understand what’s happening in your neighbourhood, our team’s always happy to chat.