From the blog...

Annual Stittsville Report

This year was shaped by a mix of political, economic, and local factors that influenced confidence in the Stittsville real estate market. A federal election in late April created some uncertainty heading into the spring. At the same time, renewed trade and tariff discussions tied to Trump’s return to the U.S. political spotlight added broader economic unease. Despite these headwinds, Stittsville remains one of Ottawa’s most desirable communities. Strong schools, amenities, and overall quality of life continue to support demand, particularly among out-of-town and military buyers relocating to the area.

Interest Rates

Interest Rates

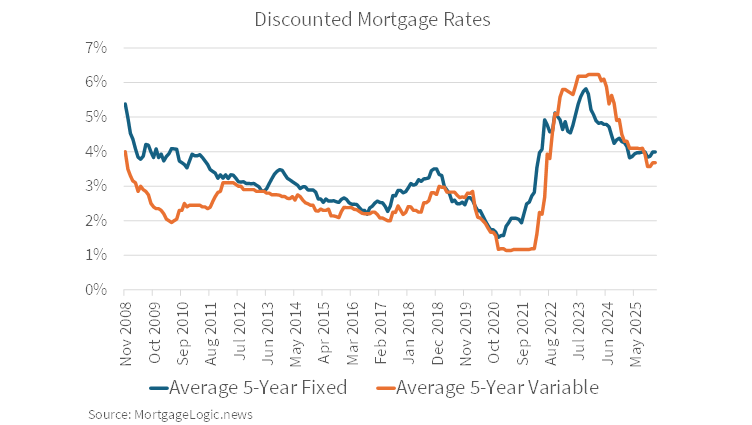

Interest rates will not be the savior in 2026. The Bank of Canada is likely to keep rates close to current levels, offering stability but not a major boost to economic activity. I anticipate a small easing of rates over time. At roughly 2.25%, we’re effectively at a neutral level. If inflation trends lower, that could open the door to additional cuts that may help stimulate things!

Public Service Job Cuts

For Ottawa, this remains the single most important factor influencing the local economy and buyer confidence. When job security feels uncertain, major financial decisions — including home purchases — tend to pause, and even the perception of potential job losses can ripple through the housing market. While this uncertainty has created hesitation, the core fundamentals remain healthy. Outside of the condo segment, which continues to face inventory challenges, most areas of the market are balanced, predictable, and functioning well — creating a more stable environment than the headlines might suggest.

Keep an Eye Out for Our Military Letter!

Every year, we send out tens of thousands of letters to connect with homeowners who might be considering selling their property. These letters are a key part of our commitment to supporting military relocation. By working with us, sellers can explore the opportunity to match their home with one of the many military members moving into our area, ready to buy with our team. If you’re thinking about selling and want to get ahead of the curve, don’t wait—reach out to us today! You can check out our military website by clicking on the image below!

Check out our full breakdown of the Ottawa Real Estate Market below. You can also listen now on Spotify!

Canada’s Housing Market Update: What the Latest CREA Data Means for Ottawa Buyers and Sellers

The Canadian Real Estate Association’s January 2026 Housing Update gives us a helpful snapshot of where the housing market is heading both nationally and here in Ottawa. While headlines often lean toward uncertainty, the data itself tells a more balanced story. For buyers, sellers, and anyone planning a move this year, there’s a lot of useful context in this update if you know where to look

——————————————————————————————————————————-

Interest Rates: Stability, Not Sharp Relief

One of the biggest questions I hear right now is about interest rates — and whether meaningful relief is coming. According to CREA’s January 2026 Housing Update, the Bank of Canada believes the current policy rate is “about the right level” to keep inflation close to its 2% target while supporting the economy through this period of adjustment (Figure 1)

Figure 1: Bank of Canada signalling rate stability rather than aggressive cuts (CREA Housing Update, Jan 2026).

What this really tells us is that we shouldn’t expect sudden or dramatic rate drops. Any improvement in affordability is more likely to come gradually. For buyers, that means planning around today’s reality rather than waiting for a big shift. For sellers, it reinforces the importance of pricing properly in a market that’s steady, but far less forgiving of overpricing.

——————————————————————————————————————————-

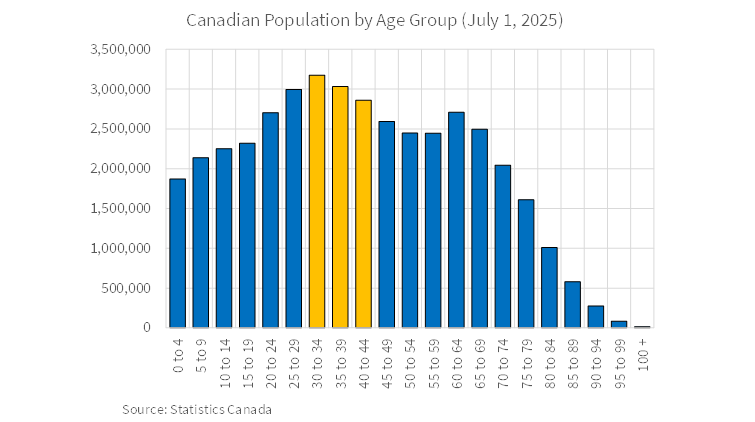

Demand Isn’t Going Away

Even with affordability challenges, the desire to own a home hasn’t gone anywhere. CREA’s presentation highlights that 75% of non-homeowners aged 30–44 still plan to buy one day, and that number jumps to 86% among those aged 18–29 (Figure 2).

Figure 2: Long-term homeownership intentions by age group, sourced from Abacus Data and presented in CREA’s January 2026 Housing Update.

This lines up closely with what we’re seeing on the ground in Ottawa. Many buyers aren’t out of the market — they’re simply waiting. Timing, financing, and life stage all play a role. The key takeaway here is that underlying demand is still very much intact.

——————————————————————————————————————————-

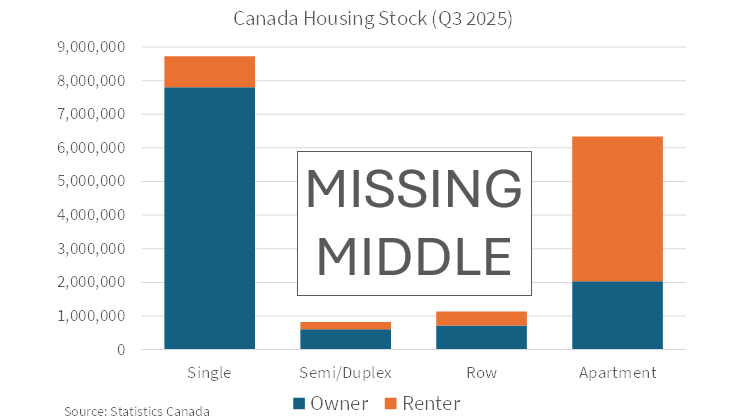

The “Missing Middle” and Ottawa’s Supply Challenge

Another major theme in the CREA update is the ongoing shortage of “missing middle” housing — things like townhomes, duplexes, and smaller multi-unit properties. These are often the most practical options for first-time buyers, growing families, and downsizers. Unfortunately, they’re also in short supply, especially in Ottawa (Figure 3).

Figure 3: Housing stock by dwelling type highlighting the “missing middle” (CREA Housing Update, Jan 2026).

This supply gap helps explain why certain segments of Ottawa’s market remain competitive, even when overall sales activity slows. When demand consistently outweighs supply in these categories, prices tend to stay firm.

——————————————————————————————————————————-

Public Service Employment and Local Confidence

CREA also points to federal budget projections showing 16,000 job reductions over three years and 41,000 over five years, starting in 2024. Importantly, many of these reductions are happening quietly through retirements and attrition rather than sudden layoffs.

For Ottawa, that distinction matters. Gradual workforce changes typically have a much softer impact on housing demand than abrupt job losses. It’s one of the reasons our local market has remained relatively stable compared to other parts of the country.

——————————————————————————————————————————-

Ottawa’s Market: Resilient, But Selective

When you look specifically at Ottawa’s new residential construction and resale activity, the picture that emerges is a market that’s functioning well — just more selective. Homes that are well priced and in desirable neighbourhoods are still selling. Properties that miss the mark on price, condition, or presentation are taking longer.

This isn’t a market driven by panic or hype. It’s one that rewards preparation, good advice, and a clear understanding of local conditions.

——————————————————————————————————————————-

Final Thoughts

CREA’s January 2026 update reinforces what many Ottawa buyers and sellers are already feeling. Demand hasn’t disappeared. Interest rates are relatively stable. Supply challenges are still very real. And while uncertainty exists, Ottawa’s housing market continues to operate with balance and resilience.

As always, the most important piece is understanding how these broader trends apply to your situation. That’s where strategy, timing, and local insight really matter.