From the blog...

Annual Real Estate Report Ottawa

Key factors and predictions for Ottawa’s housing market

This year is set to be a pivotal year for Ottawa’s real estate market, influenced by local and national factors. With a federal election on the horizon as early as April, a shift to a Conservative government could bring policy changes, including potentially cost cutting in our federal government. Any job losses will have a negative impact on the market. There is also hope that efforts will be made address Ottawa’s slow building permit process. While improvements in housing development may take time, these changes could lay the groundwork for future growth.

On the economic front, easing inflation and anticipated interest rate cuts—potentially two small reductions early in the year—are expected to boost buyer demand. However, economic uncertainty remains, with potential U.S. tariffs under Trump that could impact Canada’s economy.

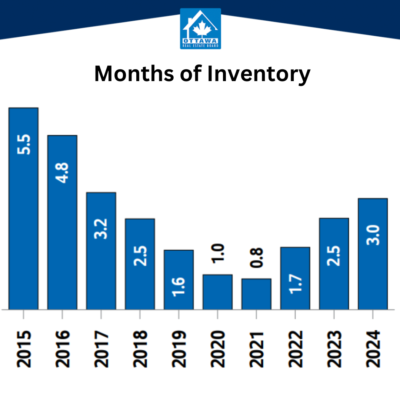

For Ottawa real estate, low inventory and rising demand could be shaping things towards a slight seller’s market by Spring. Despite challenges like higher mortgage renewal rates, housing prices are predicted to increase by 4–6% this year. Buyers may find great opportunities early in the year, while sellers can expect good selling conditions throughout 2025. If you are planning to move its a great time to strategize and prepare for this dynamic market. Whether you’re planning a move soon or later this year, now is a great time to strategize and prepare for this dynamic market.

Inflation

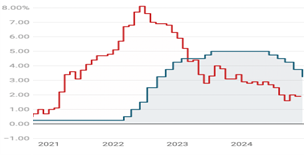

In 2024, Canada’s inflation rate experienced a significant decline, reaching 1.9% in November, down from 2.0% in October.

In my opinion, the bank of Canada overreacted originally when they hiked rates too fast and now they are bringing them down quickly. Canada also includes mortgage interest in their inflation calculation (Iceland is only other country to do so). So when they were hiking rates to lower inflation the higher interest rates also kept inflation higher. I am no economist but that sounds counterintuitive.

Looking ahead to 2025, the Bank of Canada projects that inflation will remain near its 2% target, with forecasts suggesting a slight decrease of 0.2 percentage points, reflecting a lower assumed path for energy prices.

This anticipated stability in inflation is expected to support economic growth, with GDP projected to expand around 2% over 2025 and 2026.

|

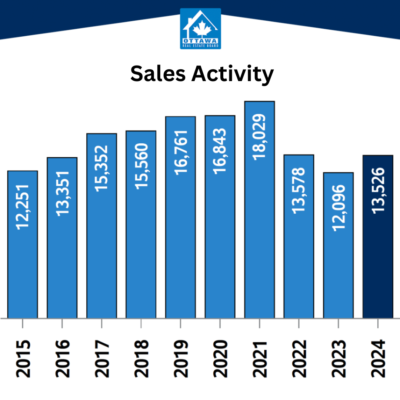

Market Dynamics Across Ottawa

Ottawa’s real estate market in 2024 showcased diverse conditions depending on the area. Older neighbourhoods like Westboro, Glebe, and some central areas had high demand and limited supply giving sellers the upper hand. In some suburbs such as Barrhaven everything leaned toward a buyer’s market, thanks to abundant new construction that gave buyers more options and leverage. Meanwhile, areas like Kanata, Stittsville, and Orleans found a middle ground, achieving balanced market conditions with steady supply and demand driven by desirable amenities and a mix of housing options. These trends highlight the importance of understanding local dynamics to navigate Ottawa’s complex real estate landscape. |

|

|

Population Growth

Ottawa’s population has been experiencing steady growth in recent years. As of 2024, the city’s population is estimated at approximately 1,451,570, reflecting a growth rate of 1% from 2023. Looking ahead, projections indicate that Ottawa’s population will continue to rise. The City of Ottawa anticipates an increase of approximately 238,540 residents from 2018 to 2035, bringing the total population to 1.6 million by 2035. Our building department is not the best. This sustained population growth is expected to drive demand in the real estate market, influencing housing availability and pricing. As more individuals and families choose to make Ottawa their home, the city’s real estate landscape will continue to evolve, presenting both opportunities and challenges for buyers, sellers, and investors. |

|

|

Interest Rate Changes

In 2024, the Bank of Canada (BoC) implemented a series of interest rate cuts, reducing the policy rate from 5% in late 2023 to 3.25% by December 2024. This monetary easing aimed to stimulate economic growth amid rising unemployment and global economic uncertainties. The real estate market responded positively, with increased buyer activity and a modest rise in home sales, as lower borrowing costs improved affordability. Looking ahead to 2025, the BoC is expected to continue its gradual approach to monetary policy, with forecasts suggesting the policy rate could reach approximately 2.25% by year-end. |

PERSONAL NOTE

As I look back on this past year, I can’t help but feel a mix of pride and gratitude. This year marks 20 years since I started in real estate—a milestone that feels both surreal and humbling. I’ve been incredibly lucky to have so many of you trust me to help with one of the biggest decisions in your life. The real estate market has been a bit of a rollercoaster this year. Shifts in interest rates and changing buyer priorities kept us on our toes, but it was also a year filled with opportunities to help clients navigate these challenges and find homes they love. Our team accomplished so much together. From hosting client events and fundraisers to helping military families settle into new homes during HHTs, we focused on building strong relationships and making the process as smooth as possible for everyone we worked with. Hitting 20 years in this business has made me reflect on how much I truly love what I do. It’s not just about houses—it’s about the people, the stories, and the relationships. Each one has shaped my career and kept me passionate about real estate. Thank you for your trust, your referrals, and for making this job so rewarding. Here’s to the last 20 years and everything the future has in store. I can’t wait to keep working with you and seeing where the next chapter takes us.