From the blog...

OTTAWA MARKET UPDATE: MAY 2020

What a strange year it has been so far. I hope everyone is doing well. With the economy starting to open up and the cases of new infections decreasing things are finally starting to head in the right direction. This might be welcome news for home buyers as they await new inventory from reluctant sellers. Many sellers have not wanted anyone coming through their home during the pandemic. In the weeks ahead we should see a spike in new listings. With the demand out there and supply shortage, it couldn’t come soon enough!

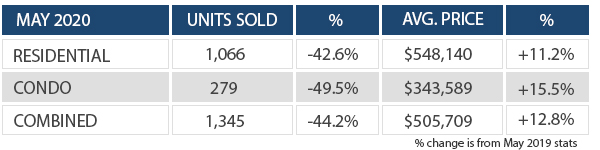

Sales in May were down 44% in Ottawa compared with the same month last year. The shortage of homes for sale in Ottawa did put upward pressure on prices. You have more buyers competing for fewer homes. Prices peaked up 11.2 over May of 2019.

The CMHC forecast for Canada house prices seemed bleak as it called for some declines across the country. Ottawa is one of the only markets that is still red hot. With interest rates now below 2% on a fixed rate the chances of this continuing are likely. Here is what our board President said about the current state of the Ottawa Real Estate market:

“with our region’s stable employment and a continuous influx of newcomers, homeowners can take comfort in the knowledge that owning a property in Ottawa and its surrounding areas is a solid investment for yourselves and future generations,”

CMHC insurance did release some new guidelines on their lending policies. This may impact some buyers and what they will be able to afford.

In a move hailed by CMHC as a method to “protect future home buyers and reduce risk”, they have announced the following changes to their underwriting criteria effective July 1, 2020. There are four main changes to CMHC’s lending policies with this announcement:

- Reducing the maximum gross debt ratio (GDS) from 39 to 35.

- Reducing the maximum total debt service ratio (TDS) from 44 to 42.

- The minimum credit score increases from 600 to 680 for at least one borrower on the mortgage.

- Non-traditional sources of down payment (i.e. borrowed from a line of credit or credit card) will not be treated as equity for insurance purposes.

The changes above apply to home buyers that are purchasing a home with less than 20% down payment where the default insurance is provided by CMHC. Based on recent previous mortgage changes, we expect that the July 1st deadline will mean those home buyers must have a firm purchase and sale agreement on a specific property and a fully committed mortgage approval by that date to be eligible under the “old” rules. This is unconfirmed at this time.

The combined increase of the GDS and TDS ratios represent a 9%-13% decrease in purchasing power for those with less than 20% down payment.

If you are curious about what is happening in your area please feel free to get in touch. We are always happy to be of service.