Posts Tagged ‘purchasing’

Posted on: January 21st, 2019 by Chris Scott

As an Ottawa realtor, I’m often asked by my clients that are both selling and buying a home, if they will have to pay CMHC again. It is an important real estate question and we want our clients to have all the answers before proceeding.

What is CMHC?

Canada Mortgage and Housing Corporation is insurance which protects the lenders and thereby allows buyers to put a lower downpayment on a purchase and in most cases allows more competitive rates.

Now knowing what CMHC is, we know it is applicable depending on the size of the downpayment and whether or not the lender would like the mortgage insured.

Here are some scenarios to help you better understand if CMHC would be applicable to you.

Staying With Your Current Lender

Conventional Uninsured Mortgage – If you are staying with your current lender and your new purchase will have a 20% downpayment or higher, you will most likely not have to pay CMHC unless your current lender requires it as part of their guidelines to be a Conventional Insurable Mortgage.

High Ratio Insured Mortgage – If you are staying with your current lender and your new Ottawa home purchase will have less than a 20% downpayment, you will most likely have to pay the top-up premium on the new amount. For example: Your home sells for $400,000. Your Mortgage amount owing is $350,000. You use the equity from the sale of your home for your new purchase of $500,000. This would approximately only be a 10% downpayment and would require you to pay CMHC and the top-up difference. The difference would be $500,000 (purchase price)-$50,000 (downpayment)-$350,000 (previous mortgage amount) = $100,000 (additional new mortgage amount). As of January 15, 2019, with a 90% L-T-V (10% downpayment) the premium on a top-up is 6.25%. So your top-up CMHC premium would be $100,000 x 6.25% = $6,250 (as a new premium would be 3.10% which would be $450,000 x 3.10% = $13,950) Also please note: your mortgage must stay at the existing amortization remaining on your current mortgage for the top up premium to be used in most cases.

Changing Lenders

Conventional Uninsured Mortgage – If you are changing your lender and your new purchase will have a 20% downpayment or higher, you will most likely not have to pay CMHC unless your new lender requires it as part of their guidelines to be a Conventional Insurable Mortgage.

High Ratio Insured Mortgage – If you are changing lenders and your new purchase will have less than a 20% downpayment, you will most likely have to pay the top-up premium on the new amount or full CMHC on the total loan amount. Whichever is less. This is where having a mortgage broker’s guidance can help answer whether it is better to pay full CMHC or the top-up premium.

Posted on: September 5th, 2018 by Chris Scott

As an owner of Ottawa investment properties, the upcoming legalization of marijuana is another element that needs to be considered when finding tenants. When this law is passed it would grant the right for individuals to grow up to four plants in their home. I certainly don’t want them growing those plants in my investment properties. It can pose health risks from the potential growth of mould, fire risk, and the significant damage due to high humidity requires. Most importantly your property value could plummet if the house was deemed to be a “grow op” This is not a label you want. Also, smoking marijuana can be worse than cigarette smell in terms of getting rid of the bad odours.

It remains for the courts to determine if a tenant’s right to smoke marijuana for medicinal purposes is greater than a neighbour’s right to not smell it, and a landlord’s right not to have it happen in their property. Especially since there are alternative forms of medicinal marijuana including pills, capsules and oil. I am sure there will be lots of upcoming cases that examine this complicated legal question. Something to watch for.

So how can you protect yourself?

Having strong clauses in your lease agreement is important. Here is one example:

Smoking, which includes tobacco and marijuana, any electronic versions and anything smoked for medicinal, recreational or remedial purposes, and growing plants of any type or quantity which includes marijuana, cannabis and hydroponics, are not permitted to be grown or cultivated anywhere in or on the premises, including common areas and the tenant’s rented unit.

I also am a big believer that the due diligence process is an important step. To be honest, if I suspect they are smokers I will not rent it to them. Even if they say they would never smoke in the house. I just don’t take the chance. Besides the credit checks, I will ask previous landlords if they were smokers and I often try to find pictures of them through facebook etc to get a sense of who they are. Might sound excessive but once your tenants are in they are hard to get out! For the record there is nothing wrong with smoking weed, I just don’t want people to smoke or grow it in my investment properties.

Posted on: February 8th, 2018 by Chris Scott

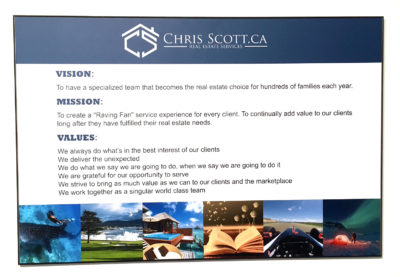

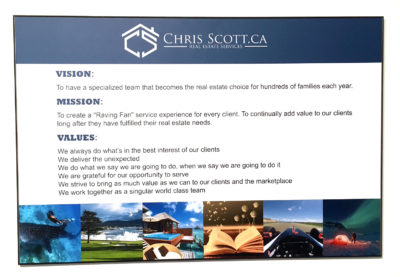

After our annual client Santa party I was approached by a past client who asked me why I do all this after sale stuff. The contests, newsletters, cards, client events etc. He said he would refer our team business no matter what, and that I really didn’t need to do all this stuff. It was an interesting question. The answer is at the heart of my business. Here is what is on our wall at the office:

We are just living out our mission statement. That is what gets me fuelled up every day and excited to go to work. You see our mission in real estate is to create a raving fan service experience for every client and to bring value long after our clients buy or sell. We will always strive to provide this service to clients if they bought 12 years ago or 12 months ago. As our team grows we are able to offer better services and bring new experiences. I look forward to sharing some new initiatives with everyone in the near future.