From the blog...

What’s Really Happening in Ottawa’s Housing Market Right Now

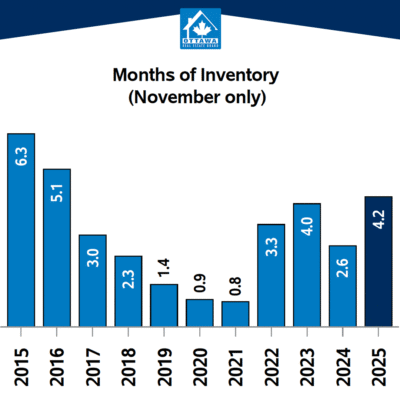

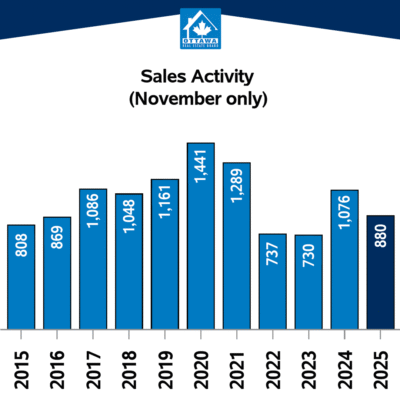

The shift has been slow and steady, but November really highlighted where things are heading. Ottawa is still technically sitting in a balanced market, yet different segments are starting to move in very different directions — and some are shifting quickly.

Condo apartments, for example, have climbed to seven months of inventory, a notable jump that firmly places that segment in buyer’s-market territory. (For context, months of inventory measures how long it would take for all current listings to sell if no new ones came on the market.) Seven months means buyers have leverage and plenty of choice.

By contrast, single-family homes are holding steady at roughly four months of inventory, and townhomes are even tighter at around three months — both still within balanced-market conditions. But as always, Ottawa is really a collection of micro-stories. For example, if you’re buying or selling in Westboro, The Glebe, or downtown under $1M, you’re seeing something completely different from the citywide averages. Inventory in these pockets is incredibly tight, competition is high, and well-priced homes are moving fast. So even though the overall market reads “balanced,” your lived experience may feel far more competitive.

Layered on top of all this is the Bank of Canada’s latest decision to hold interest rates steady. This means we’re heading into the new year with what I’d call a neutral rate environment — rates aren’t pushing the market forward, but they’re not pulling it back either. A rate cut would certainly help unlock more momentum (and yes, selfishly, I’d love to see that), especially as inventory builds in certain segments.

If you’re curious about what’s happening in your specific neighbourhood or want a breakdown of recent sales around your home, feel free to reach out anytime. Every pocket of the city is behaving differently right now, and we’re always happy to walk you through it.

We’ll also be sharing a more detailed 2026 market forecast in the next blog post. There’s a lot to unpack, and I’m looking forward to diving deeper with you!