Archive for the ‘Chris’ Blog’ Category

Posted on: June 6th, 2017 by Chris Scott

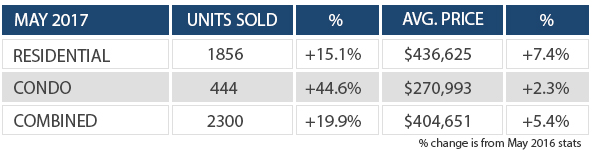

RAINING SALES IN OTTAWA

It was raining sales in the Ottawa real estate market last month. Amid one of the rainiest months ever, we also experienced the busiest real estate market in Ottawa history. We absolutely shattered the previous record by over 315 units. The Ottawa residential market has been hot for a while now but the condo market is also coming alive which is leading to this extremely active market. Condos sales activity is up 44.6% over May of last year. In total 2300 units were sold last month! That is up from 1919 units sold in May of 2016. This includes both condos and residential freeholds.

In most neighbourhoods, Ottawa is in a seller’s market. There is just not much inventory and lots of demand. Multiple offer situations are very prevalent in the central neighbourhoods. Freehold prices are up 7.4% over May of 2016 while Condo’s are up 2.4% over May of last year.

Now more than ever it is important to get the advice of an agent. Pricing/marketing strategies are different for every neighbourhood. If you are interested to see what your home would sell for in this market please feel free to get in touch.

If you are curious about your homes worth please fill in this form for a no-obligation market assessment.

Posted on: May 26th, 2017 by Chris Scott

Home staging is such an important aspect of selling your home. In Ottawa, home buyers have lots to choose from. It’s important to make the right first impression. These Ottawa sellers worked with our staging team to make sure their house sparkled when it hit MLS. They ended up selling in a week for 99.8% of listing price. As you can see this hard work staging paid off for these clients.

Create A Unique Space

The dining room just needed a few large accessories to give it impact. For our team, the biggest difference was adding the drapes. It helped define this space as a separate room. The living and the family room both had the matching filtered blinds so having the drapes in this room made it different. It was also another way to bring texture and colour to the room.

Living in a Staged House

This can be hard when you have young children. The goal is to make it looks it’s best so it sells quicker and you can resume your ‘normal’ living. Removing the toys made a huge difference and it elevated the look of sophistication in this house. Look how beautiful the floors are. You always want to showcase the beauty in your home.

Time to Borrow from Family and Friends

We were very lucky that their friends were kind enough to lend them their sofa. It is very understandable if sellers don’t want to buy furniture if they don’t know what they are moving to. We ask sellers to borrow from family and friends if possible. The whole purpose of Staging is to keep your costs down, for the most profit.

Posted on: May 5th, 2017 by Chris Scott

Our staging team last month did an extraordinary job transforming this home. Having the rooms painted made a significant difference in the results. Check out the before and after pictures below.

As our staging team walked into this house back in December, we knew it needed to be painted. The homeowners were very reluctant and it took some convincing that they would get their money back in the paint. We are happy that they decided to go ahead with it and hire professional painters to make sure the job was done right. These homeowners were amazing to work with. They did whatever we asked them to do and were more than willing to buy what we suggested. Once the painting was done, we were surprised how quickly we could turn it around.

Neutral Walls and Furniture Placement

The living room walls made the room feel small and dark and their U-shape sectional dominated the room. When homeowners get transferred around a lot for work, it can be challenging for them to know what furniture to buy, that will fit in other houses. We also felt that the TV dominated the room.

The neutral walls completely transformed the room. We needed more furniture for the office loft, so moving part of the sectional upstairs enhanced both rooms without costing anything, They also switched the large TV for a smaller one that they already had. We love the challenge of rearranging the furniture in different rooms to repurpose it.

Removing the white floor lamps with a stylish table lamp softened the room. Their new gray shag carpet is something that they will be able to use in their next house. It adds texture and expands the space making the room feel larger. Notice they even spray painted the brass around the fireplace with BBQ heat retardant paint.

We brought in large artwork to tie the whole main living space together. You are always better with fewer larger pieces than several small pictures for Stagings. Their new chair invited you into the room and created a welcoming space for conversation, not just TV.

Dining in Style

We were concerned about painting these gold walls since they were ragged with glaze and had texture. This could really scare off buyers. This is why we were so happy they hired professionals. They also had too much furniture in the room.

Once the large cabinet was removed, they were able to turn the table to the other direction. This made it mush easier to walk around. You only need a few large accessories to give some drama. Removing the valance from the window also updated the look.

Kitchen Cabinets

Replacing or even painting kitchen cabinets can be risky since you really don’t know what buyers are going to want and it’s an expensive task. It’s safer to just make them look their best. These cabinets are in perfect condition so it would be a shame to change them unnecessarily.

The new wall paint colour worked with the floor and neutralized the colour of the cabinets.

Tone it Down

The office/den room was a catch-all room and we really wanted to give it a purpose for resale. We moved this futon downstairs in the family room, removed all the storage bins, brought in a desk and continued the same paint colour upstairs.

Buyers can see this as a home office, a guest room or den. The homeowners’ had their father’s photography blown up as a surprise. We love it when you can still personal touches in a house.

Work With What You Have

When our staging team walked in, this children’s room didn’t make sense to me. It had adult furniture but a youthful painted mural. This mural was here when they bought the house. They didn’t have any children but one of their relatives had a crib that they weren’t using.

Now, this room looks like an adorable nursery that might just be the selling feature. If buyers don’t like it, they can always paint over it but it was faster for us to just put in the crib, remove the other furniture and put up some white drapes to keep it looking fresh. The crib also makes the room feel larger than a queen size bed.

Master Bedroom Gets Some Drama

They were already starting to pack up some of their things. New drapes, linens and artwork were the biggest change in this room. They didn’t have a headboard but this canvas artwork creates the illusion of one and gives the bed some height. The matching lamps also give symmetry. The turquoise drape panels on both windows extend the colour to the far end of the room. A few simple accessories give the room atmosphere. The round shape of the mirror softens all the edges of the room.

Posted on: May 5th, 2017 by Chris Scott

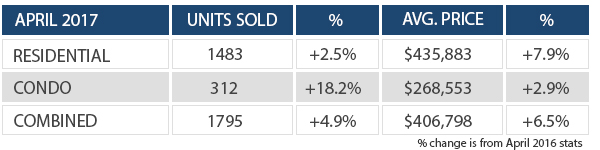

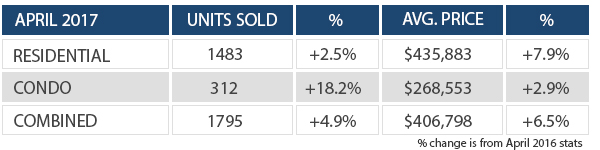

The balanced market of the past few years has seemed to evaporate overnight. The market is extremely competitive right now in Ottawa. A shortage of good inventory and favorable demand has shifted the balance towards the sellers. Bidding wars are once again a common practice here in Ottawa. The exception this year is that some of the bidding wars are escalating high above the listing prices. In one instance I witnessed a home sell for 100k more than a sellers list price. It started in March and was mostly contained to the central urban market. Neighbourhoods like Hintonburg and Westoboro are especially hot. That heat has extended to the suburban market, It is not as active but in some segments of the market, every well-priced home is in multiples. As an example, it took my clients 5 offers to secure a Kanata townhouse. They were over asking on all 4 of the previous bids. Every neighbourhood has different trends. Much it will depend on the available inventory in each area. Comes back to simple economics sometimes. Low supply + high demand = Craziness in the Ottawa market.

Let’s examine the April resale numbers for the Ottawa market:

This upwards push is fuelled by a combination of high consumer confidence and good local economic conditions. Houses sold over 1M doubled this April compared to last year. There were over 83 properties sold in the 7 digits! This is an interesting trend to keep an eye on. If you have questions about your neighbourhood trends feel free to get in touch.

Posted on: April 5th, 2017 by Chris Scott

The Ottawa Real Estate market is heating up. Price gains for both residential and condo units are up 5.3% year over year. The average sale price of a residential property was $415,467 and $272,597 for condos. Sales are up 28% over last year and we are just shy of the all-time record for March sales.

The core of the city is as active as I have seen it in years. There are limited inventory and lots of demand. This has created many situations where sellers are getting much more than asking price. In one instance I witnessed a home sell for 100k over asking price. It is a challenging market for buyers right now. Especially in the areas around Wellington village and Hintonburg. These areas are experiencing multiple bids on almost every house!

In the suburbs, the economics are more balanced. There is a reasonable amount of inventory and multiple bid situations are rarer. However, it is more active than in years past. It is going to make for a very interesting Spring market. The traditional busy season is still yet to be upon us.

The market has different patterns depending on your neighbourhood and category of home. If you are interested to know what’s happening in your neighbourhood, feel free to get in touch.

Posted on: March 21st, 2017 by Chris Scott

I represent many buyers looking to purchase new homes in Ottawa. Often times clients are asking what upgrades they should do. Beyond the obvious upgrades such as kitchen, flooring, and bathrooms, here are some other upgrades that often fly under the radar.

1. Outlets Under Eaves

1. Outlets Under Eaves

Adding outlets underneath your eaves with a switch in the hall closet allows you to decorate your home for Christmas with no limits! It’s a much better alternative to having extension cords connecting everywhere.

2. Dimmer Light Switches

2. Dimmer Light Switches

Adding this lighting option to certain spaces makes them more usable and comfortable. Instead of just having the options of on or off it allows control of the amount of light in each room. Also, beyond the functionality appeal of being able to dim lights, it also saves energy and the light bulbs can be used longer. You can create the warm candle vibe and save on your electricity bill.

3. Central Vac (Kickplate in Kitchen)

3. Central Vac (Kickplate in Kitchen)

There are multiple reasons why homeowners prefer central vac over a vacuum. These benefits include no power cords or extension cords, no re-circulated dust particles, large trash capacity, lightweight and easier to use. It makes cleaning your garage easier as it doesn’t stir up dust like a broom, and is a lot less troublesome than trying to use a portable vacuum outside.

4. Larger Basement Windows

4. Larger Basement Windows

Allowing more natural sunlight into the basement increases the appeal of the extra living space. Many basements are used for just storage but if it’s finished or if someone lives in it, the natural sunlight has health benefits. Natural sunlight increases circulation, energy, encourages better sleep and causes vitamin D production. They also can provide easier escape routes in case of an emergency.

5. Undermount Sinks

5. Undermount Sinks

Seamless looks are very popular these days. An undermount sink attaches to the underside of the countertop, this way there’s no raised edge on the top of the counter, where food might collect.

Other upgrades mentioned included: LED pot lights, USB outlets, exterior hot water tap, if there is a soaker tub to add a sprayer, wall speakers, and outlets near stairs for Christmas lights. If you are buying a new home in Ottawa, please get in contact with me, as I’d be happy to help. I have relationships with most new builders in Ottawa and also have some custom home options aswell.

Posted on: March 8th, 2017 by Chris Scott

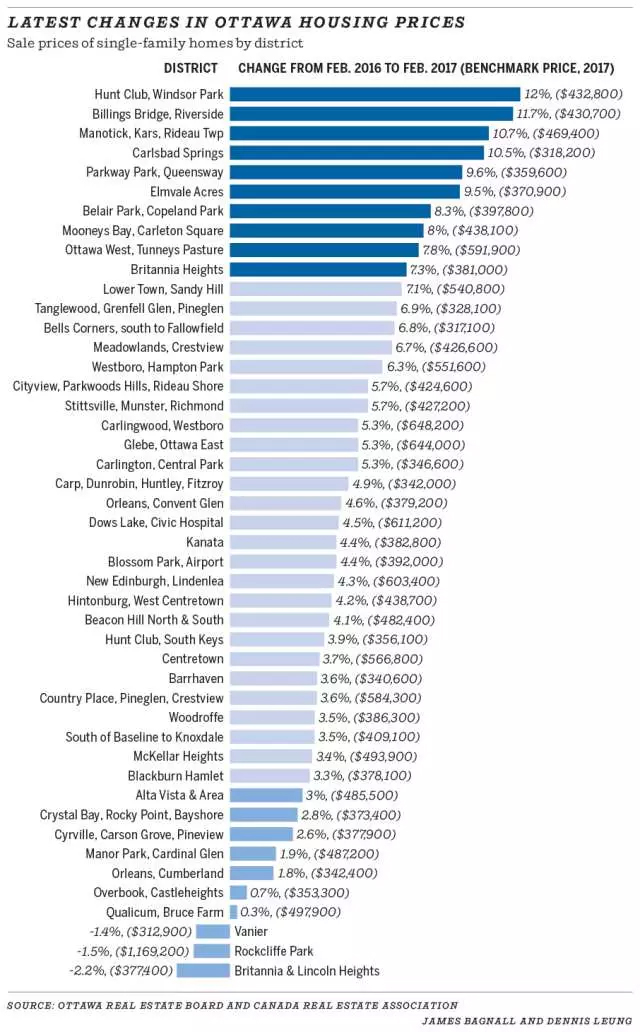

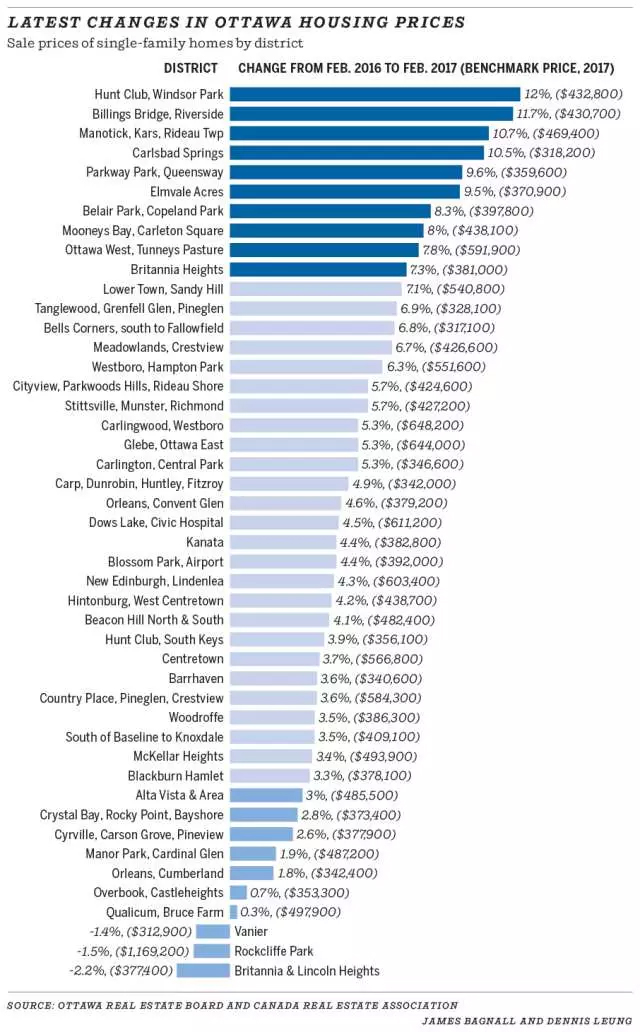

According to the OREB the average sale price in Ottawa last month jumped 8.5 per cent to $417,400 from February the previous year. There were over 1000 transactions which is higher than the previous five years. The February average over the past five years was 872. This higher-than-usual transaction reduced the inventory of available homes but we consider the market to still be roughly in balance between buyers and sellers.

Almost half of the residential sales involved two-storey houses. The sale price in this segment in February averaged $440,300 which is up 10.5 per cent from February 2016. Prices for bungalows averaged $366,000, which are also up 2.3 per cent from February last year.

Please see below the sale price changes for single-family homes from February 2016 to February 2017 by Ottawa districts.

Posted on: March 2nd, 2017 by Chris Scott

Early this year my clients were all set to hit the market. We had a price locked in and papers were signed. Before hitting the MLS my stager Heather met with my clients and put together a game plan to get the house ready. They had it freshly painted and every room was wonderfully staged. I came in to do a video and we got all the marketing pieces in place. Just before we launched our listing the exact same model came for sale around the corner.

The thing is, it came to market at $60,000 less! I think I spit my coffee out when I saw that. I immediately went and previewed the house. Same square footage and both had unfinished basements. My listing had hardwood on the stairs and in the master bedroom where they only had carpet. There were no other major differences: except cleanliness and effort put into the preparation of the house. We decided to go ahead and compete with this other house. Fortunately for us, we were able to secure a buyer before the other listing. During the negotiation, this other property was certainly brought up but we still managed to secure top dollar for our clients. We obtained 99% of our list price while they only received 95% of their list price. This equated to an additional $83,000 in my client’s pockets.

This is a great case study on why preparing your home for sale can have a huge payoff. Having a professional guide you through the process and negotiate in your best interest is crucial for getting top dollar.

Posted on: February 22nd, 2017 by Chris Scott

Of all the applications for virtual reality, real estate might be the most practical. How would you like to view a home sitting in the comfort of your living room?

I believe this will be the way initial showings will be conducted in the years ahead. The technology already exists to complete a great VR walkthrough. I experienced it myself at a recent tradeshow. It truly felt like I was in the house. I was so excited about this I have added it as part of my services. The challenge is that consumers don’t have the headsets. It isn’t quite mainstream enough yet. My personal opinion is that almost every household will have some type of VR gear in the next 3-5yrs. It can be just a $30 google box that I am pictured with or something a little more high-tech. The future is going to be weird. I just imagined a family sitting around the dinner table with their VR headsets on. Yikes, sometimes more technology is not necessarily better.

MY PREDICTIONS:

A better version of the google box or something Apple is secretly working on will be the mainstream choice for consumers. Smartphones will be the tool that people will use to get their VR fix. I see phones that are curved or have the ability to be curved into the box to create a cool experience. This will allow home shoppers to take walkthroughs of homes and really narrow their list down before seeing homes in person. When they have their short list I will be sending my self-driving car to pick them up. Some aspects of VR I am excited about. I just hope people will not substitute real life experiences for those manufactured by VR. To understand this you must try VR, It truly feels real. It will be interesting to see how we develop and use this technology in the years ahead.

Posted on: January 26th, 2017 by Chris Scott

As an Ottawa Realtor I am often asked about the closing process with a lawyer. I have included an example letter from an Ottawa lawyer to highlight what happens behind the scenes. The closing date is the day when you finally take legal possession of your new home. This date is specified in your Agreement of Purchase and Sale. The final signing usually happens at the lawyer or notary’s office. The purchaser will receive their keys to their new home and the vendor will receive their funds from the sale. The closing date is often at least 3 weeks after the vendor has accepted the offer. This is to allow the lawyer time to collect all the required conditions in order to complete the deal.

Please view the example letter below:

This letter is to help prepare purchasers of the required conditions before and on the closing date. It includes the following details:

- Closing Date

- Fees and Disbursements

- Title

- Mortgage

- Insuring Title to Your Property

- Intended Use and Characteristics of the Property

- Fire Insurance

- Utilities

- Keys

- Signing

- Identification

1. Outlets Under Eaves

1. Outlets Under Eaves 2. Dimmer Light Switches

2. Dimmer Light Switches 3. Central Vac (Kickplate in Kitchen)

3. Central Vac (Kickplate in Kitchen) 4. Larger Basement Windows

4. Larger Basement Windows 5. Undermount Sinks

5. Undermount Sinks