OTTAWA MARKET UPDATE: MAY 2023

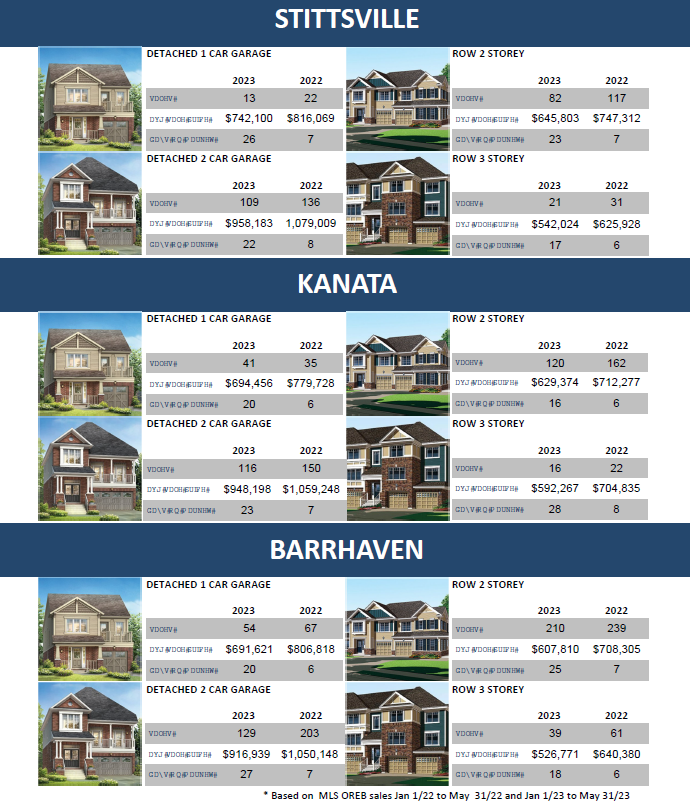

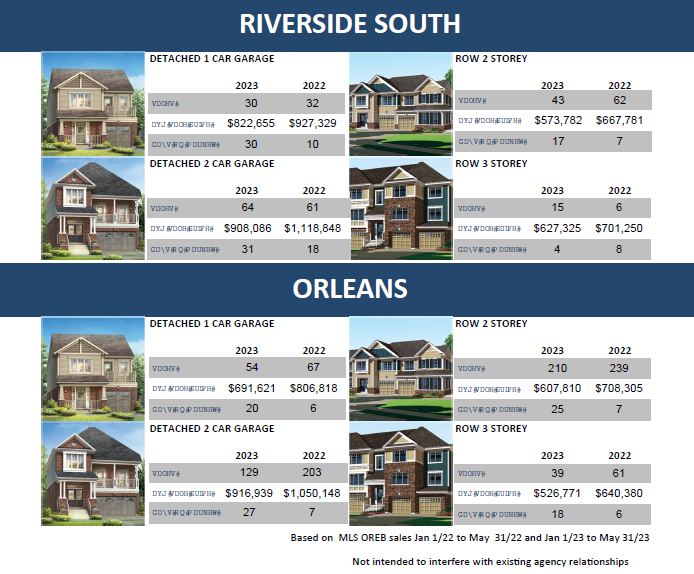

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. This series showcases statistics for the 5 largest urban neighbourhoods in Ottawa.

As Ottawa is such a spread-out city it’s great to see the variances from area to area. All of these statistics are based on MLS OREB sales from January 1, 2022, to May 31, 2022, over January 1, 2023, to May 31, 2023.

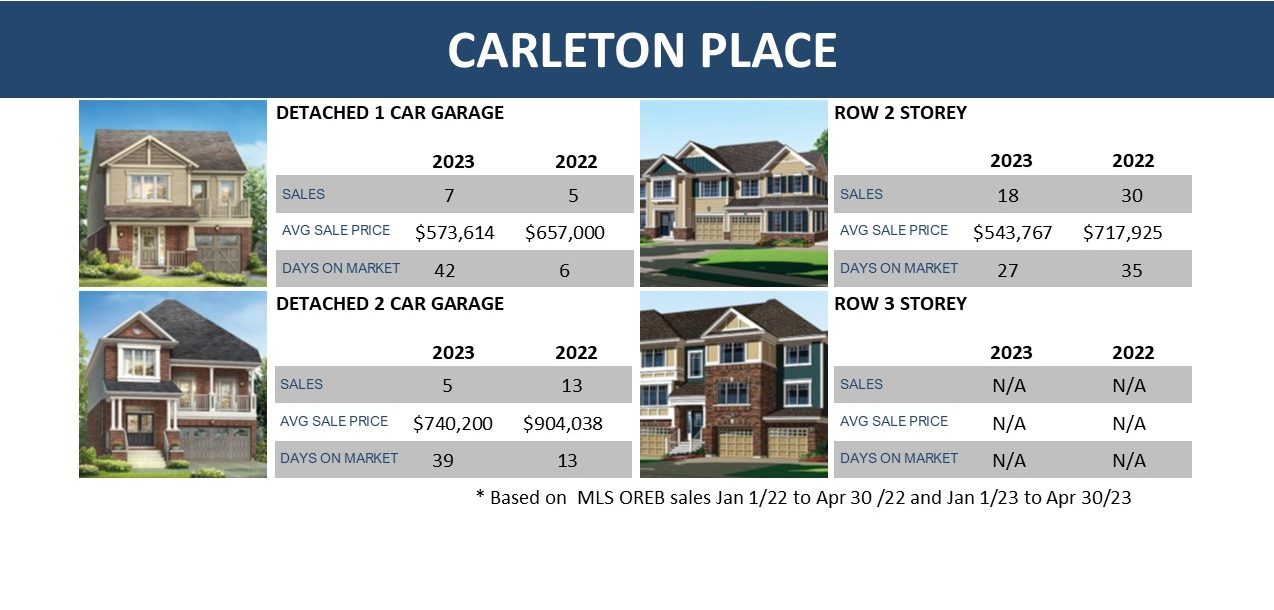

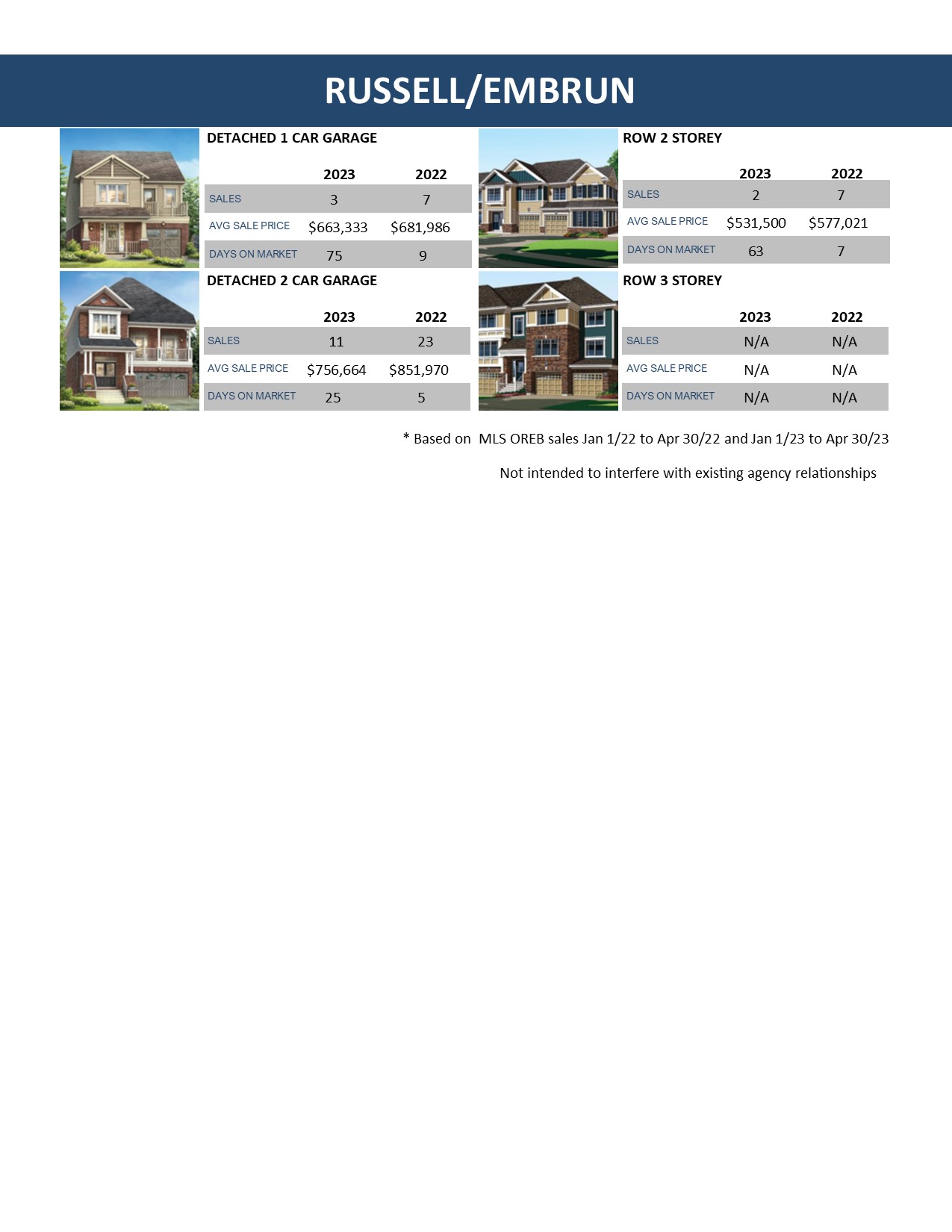

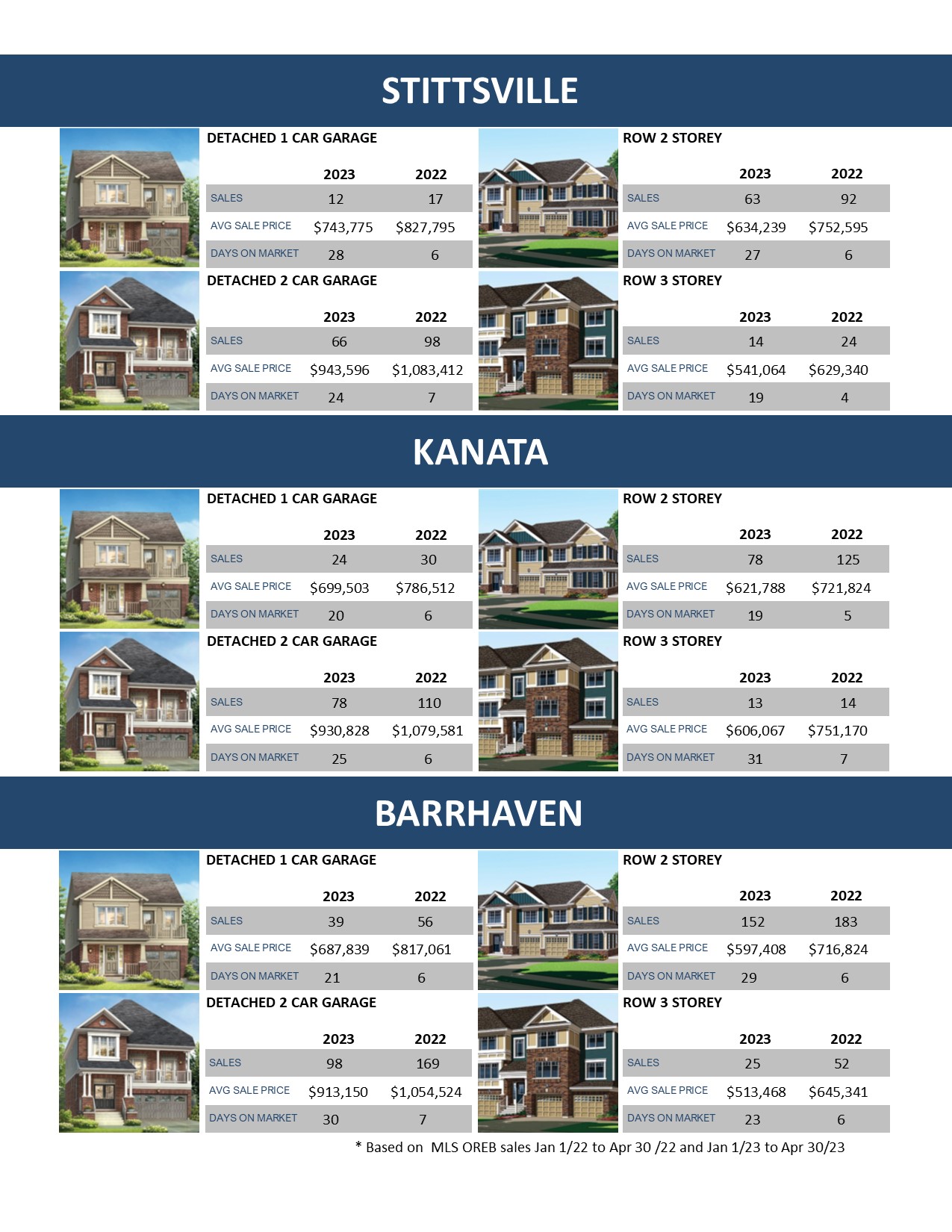

With prices in the city continuing to increase, many of our buyers are starting to look at purchasing just outside the city. Our team has put together the latest statistics for Carleton Place, Russell, and Embrun.

All of these statistics are based on MLS OREB sales from January 1, 2022, to April 30, 2022, over January 1, 2023, to April 30, 2023.

|

|

|

|

|

|

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. This series showcases statistics for the 5 largest urban neighbourhoods in Ottawa.

As Ottawa is such a spread-out city it’s great to see the variances from area to area. All of these statistics are based on MLS OREB sales from January 1, 2022, to April 30, 2022, over January 1, 2023, to April 30, 2023.

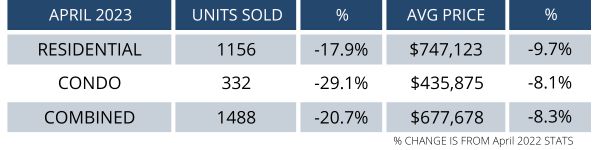

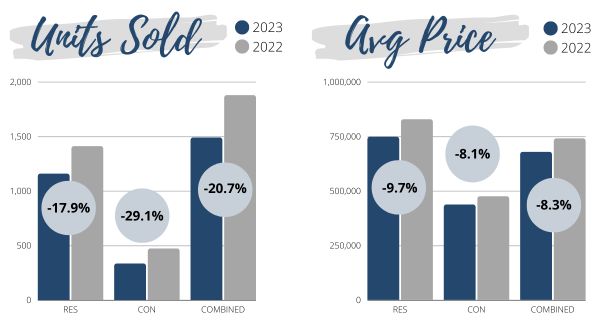

Interesting times right now in the Ottawa Real Estate market. The spring surge seems to be in full swing and will be helped by record temperatures this weekend. Snow is gone and many buyers are re-engaging in their searches. Here is a snapshot of what is happening right now:

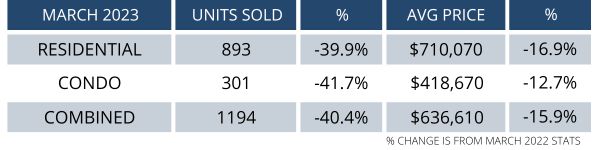

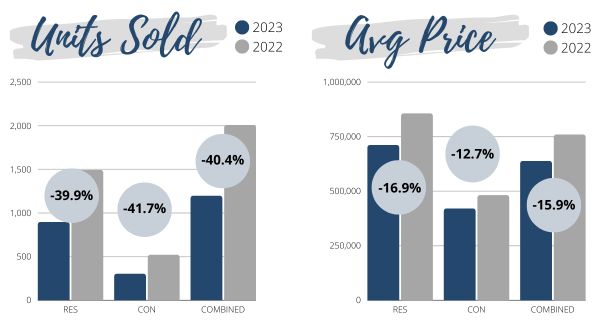

In March, members of the Ottawa Real Estate Board (OREB) sold 1,194 residential properties through the Board’s Multiple Listing Service® (MLS®) System. This represents a decrease of 40% compared to March 2022, with 893 sales in the freehold-property class (down 40%) and 301 sales in the condominium-property category (down 42%). However, March sales transactions increased by 40% compared to February. The five-year average for total unit sales in March is 1,698.

OREB President Ken Dekker noted that the recent rise in transactions is a sign of typical spring activity, even though it is behind the pandemic peaks of 2022. As spring unfolds, a clearer picture of Ottawa’s balanced market state will emerge. The way I see it is, it may be another seller’s market this year with less than 3 months’ worth of inventory.

The average sale price for a freehold-class property in March was $710,070, down 17% from 2022 but up 0.2% from February 2023. Average freehold prices have risen by approximately 8% during Q1 2023 compared to December 2022’s market low. The average sale price for a condominium-class property was $418,670, down 13% from a year ago but up 2% from February 2023. Year-to-date average sale prices for freehold-class properties and condominium-class properties were $701,837 and $414,698, respectively, representing a 16% and 11% decrease from 2022.

OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Every neighbourhood is different. If you want to know what’s happening in your area please feel free to get in touch.

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. This series showcases statistics for the 5 largest urban neighbourhoods in Ottawa.

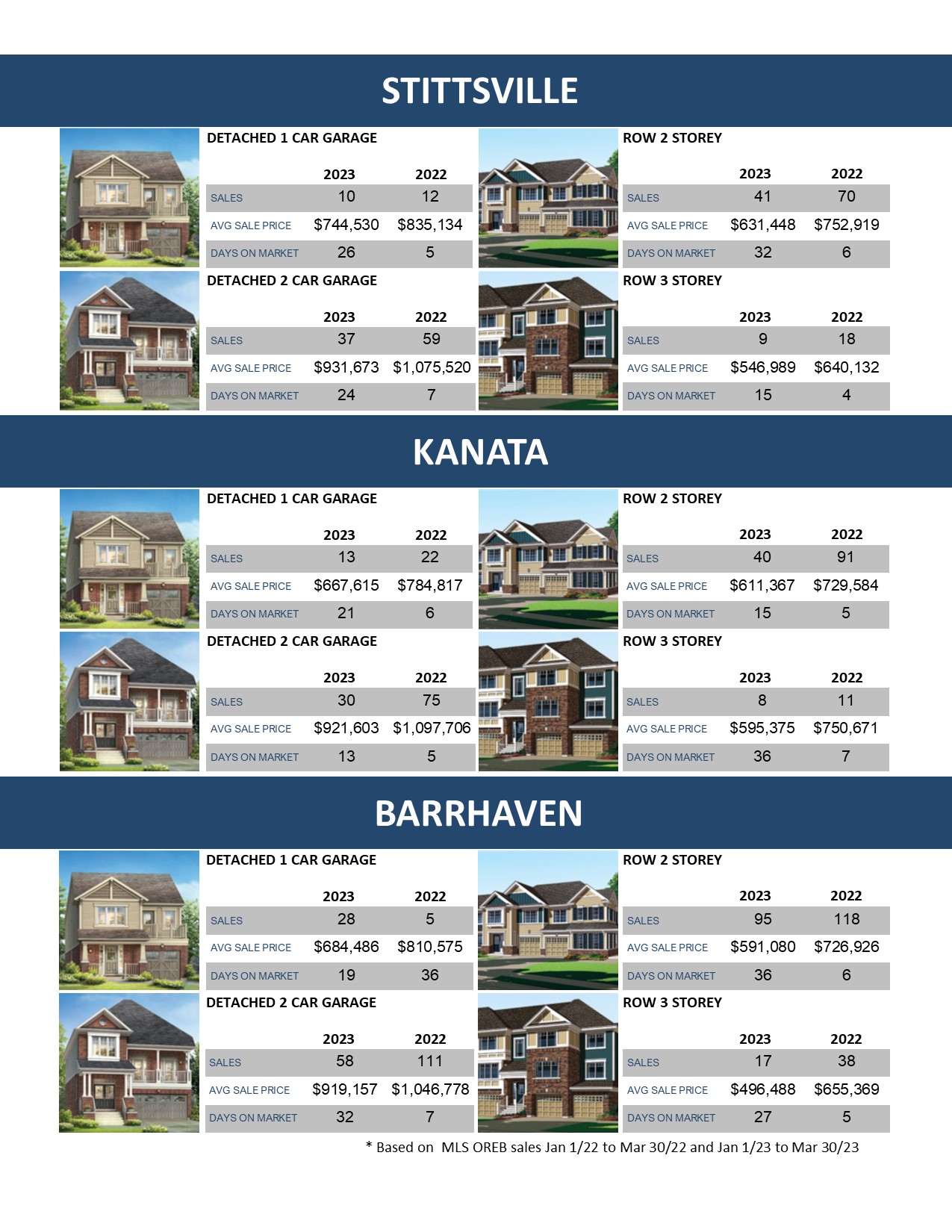

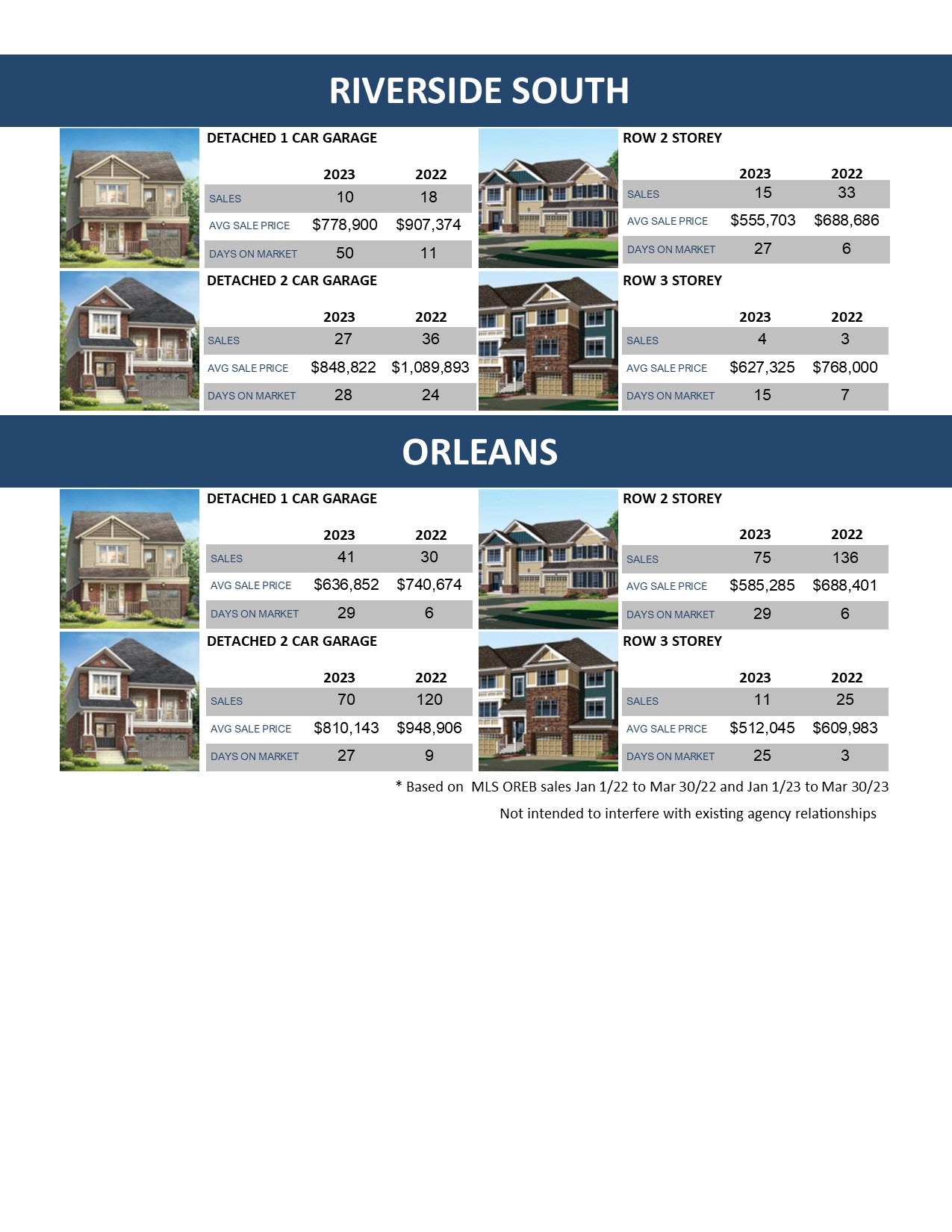

As Ottawa is such a spread-out city it’s great to see the variances from area to area. All of these statistics are based on MLS OREB sales from January 1, 2022, to March 30, 2022, over January 1, 2023, to March 30, 2023.

The Stittsville real estate market has had an incredible roller coaster ride of prices since the pandemic began in 2020. With prices peaking in early 2022. Since that time Bank of Canada’s measures to fight inflation through interest rate hikes has had a significant impact on house prices in our community. For this report, we are comparing prices from the first quarter of this year against the first quarter of last. Here are the results of this comparison.

What jumps out to me is that both detached 2-car garage homes and row units declined the most in value. Stittsville remains more expensive than all the other major suburbs in Ottawa. It is continually on the list of my relocating clients.

I predict that the market will get better as I’m already seeing lower inventory and the return of multiple offers in some cases. Buyers who are well qualified, but maybe have been on the sidelines since the declines have re-entered the market as they may feel like house prices have bottomed out. The challenge these buyers are facing is that inventory levels are still low by historical standards. Not quite where they were last year, of course, but much lower than anyone is talking about. The wildcard is if the Bank of Canada keeps their current rate steady and we can see some stabilization back in the market. I have actually heard rumours that some banks may even reduce their current rates in the weeks ahead. If that happens we will have a busy Spring and Summer market.

It is very important for sellers to create an experience for their prospective buyers to get the most amount of money possible. What that looks like to me is having the house staged, marketed properly, and easy to buy. Our team specializes in selling in the Stittsville area and can make sure you get the absolute most money you can for your home in the least amount of time. If you are curious as to what your home is worth please feel free to reach out.

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. We are bringing you specific real estate market statistics for Stittsville. The market is different depending on what area of Ottawa you look at. This gives you a specific snapshot of the first-quarter statistics for 2023 in Stittsville.

All of these statistics are based on MLS OREB sales from January 1, 2022, to March 30, 2022, over January 1, 2023, to March 30, 2023.

When purchasing a home it is important to know what the extra costs will be. The projections below are an estimate of expenses involved in a typical real estate purchase. Not all of these costs* will apply in all circumstances.

| LEGAL/ RELATED FEES | INSPECTION COSTS | |||

| Lawyer Fee | $900-$1100 | Home Inspection | $500-$600 | |

| Legal Disbursements | $600-$800 | Status Certificate | $100 | |

| Prepaid Taxes or Utility Bills | To be determined | Septic Inspection | $500 | |

| Title Insurance | $270 | Water Inspection | $450 | |

| MOVING COSTS | ||||

| Moving Company | $600-$4000 | |||

| Utility hook ups etc. | To be determined | |||

| Change of locks | $100 | |||

| PURCHASE PRICE | LAND TRANSFER TAX | LOAN-TO-VALUE RATIO | PREMIUM RATE | |

| $300,000 | $2,975 | Up to and including 65% | 0.60% | |

| $400,000 | $4,475 | Up to and including 75% | 1.70% | |

| $500,000 | $6,475 | Up to and including 80% | 2.40% | |

| $600,000 | $8,475 | Up to and including 85% | 2.80% | |

| $700,000 | $10,475 | Up to and including 90% | 3.10% | |

| $800,000 | $12,475 | Up to and including 95% | 4.00% Traditional Down Payment | |

| $900,000 | $14,475 | 4.50% Non Traditional Down Payment | ||

| $1,000,000 | $16,475 | |||

| $1,100,000 | $18,475 | |||

| $1,200,000 | $20,475 | |||

| $1,300,000 | $22,475 |

*Please note: these costs are merely an estimate and are only provided as a ballpark estimate of what to expect when purchasing a home.