Posted on: January 27th, 2026 by Chris Scott

The Canadian Real Estate Association’s January 2026 Housing Update gives us a helpful snapshot of where the housing market is heading both nationally and here in Ottawa. While headlines often lean toward uncertainty, the data itself tells a more balanced story. For buyers, sellers, and anyone planning a move this year, there’s a lot of useful context in this update if you know where to look

——————————————————————————————————————————-

Interest Rates: Stability, Not Sharp Relief

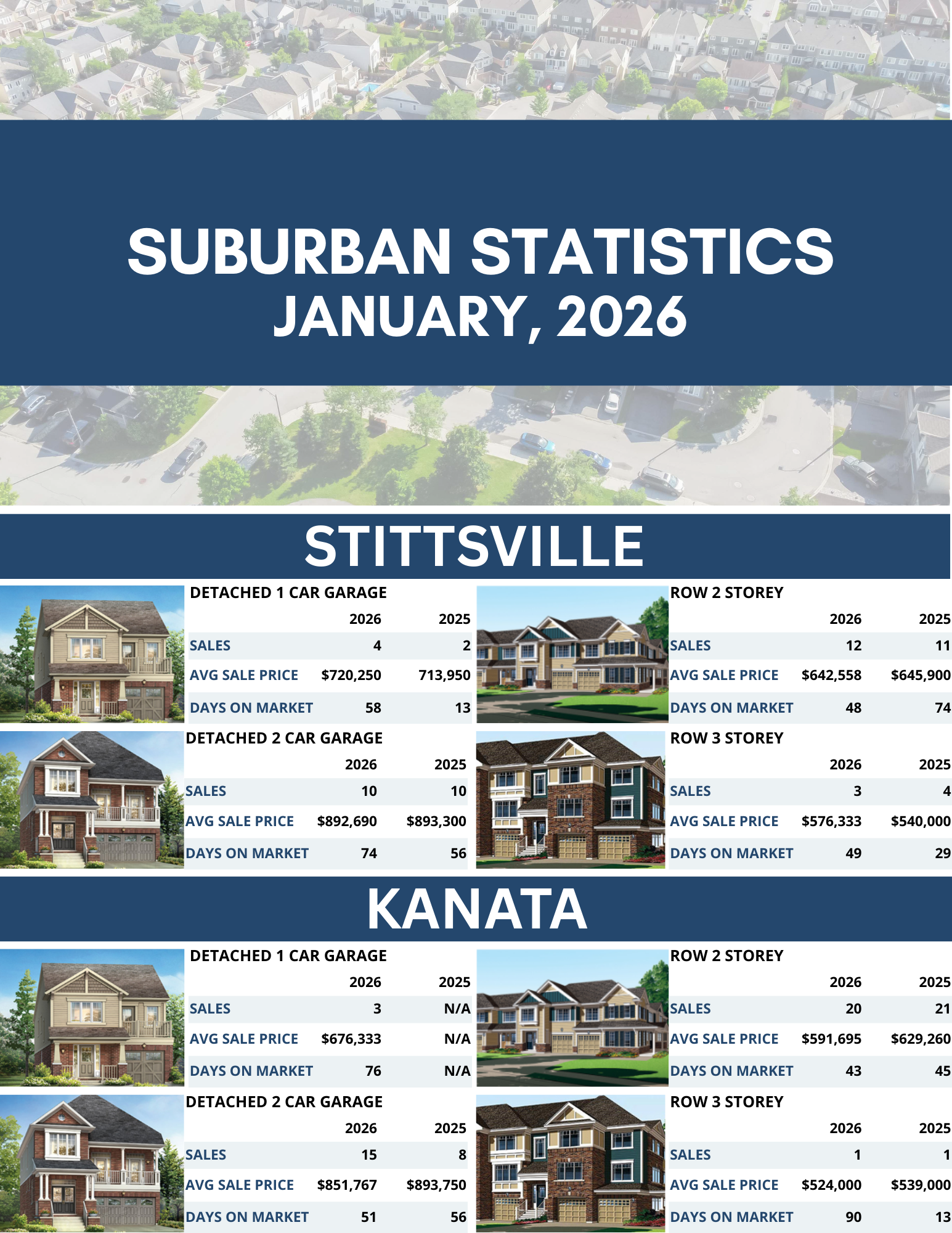

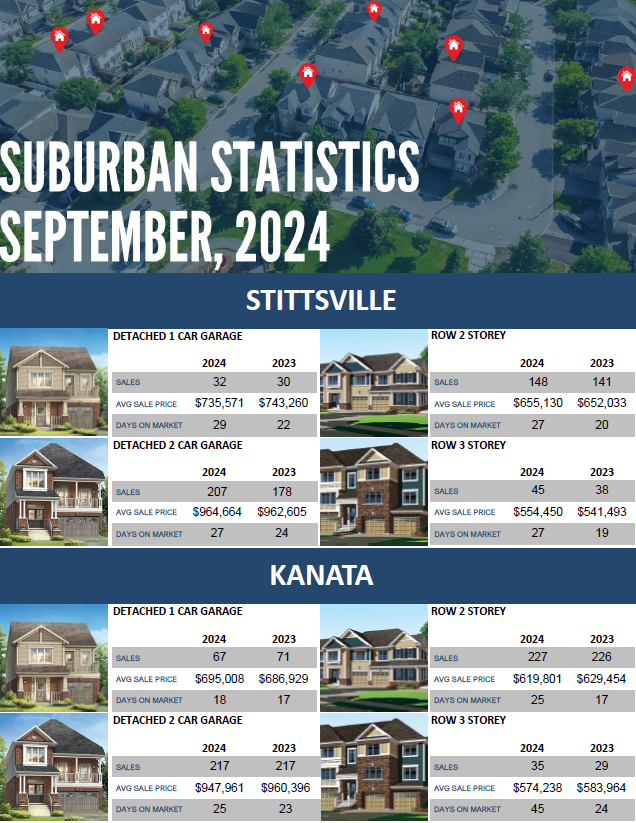

One of the biggest questions I hear right now is about interest rates — and whether meaningful relief is coming. According to CREA’s January 2026 Housing Update, the Bank of Canada believes the current policy rate is “about the right level” to keep inflation close to its 2% target while supporting the economy through this period of adjustment (Figure 1)

Figure 1: Bank of Canada signalling rate stability rather than aggressive cuts (CREA Housing Update, Jan 2026).

What this really tells us is that we shouldn’t expect sudden or dramatic rate drops. Any improvement in affordability is more likely to come gradually. For buyers, that means planning around today’s reality rather than waiting for a big shift. For sellers, it reinforces the importance of pricing properly in a market that’s steady, but far less forgiving of overpricing.

——————————————————————————————————————————-

Demand Isn’t Going Away

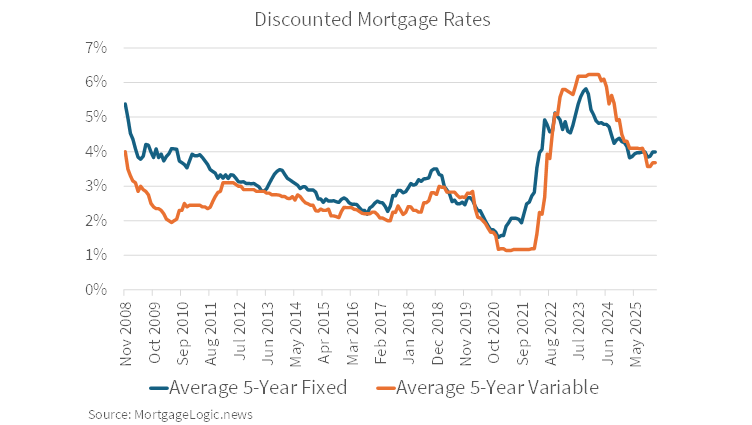

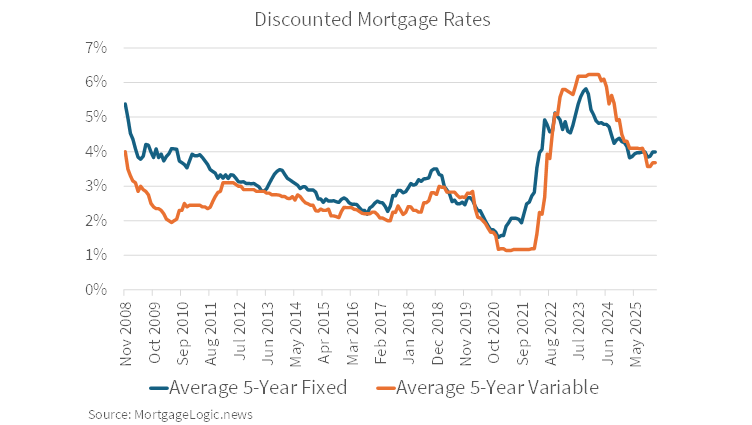

Even with affordability challenges, the desire to own a home hasn’t gone anywhere. CREA’s presentation highlights that 75% of non-homeowners aged 30–44 still plan to buy one day, and that number jumps to 86% among those aged 18–29 (Figure 2).

Figure 2: Long-term homeownership intentions by age group, sourced from Abacus Data and presented in CREA’s January 2026 Housing Update.

This lines up closely with what we’re seeing on the ground in Ottawa. Many buyers aren’t out of the market — they’re simply waiting. Timing, financing, and life stage all play a role. The key takeaway here is that underlying demand is still very much intact.

——————————————————————————————————————————-

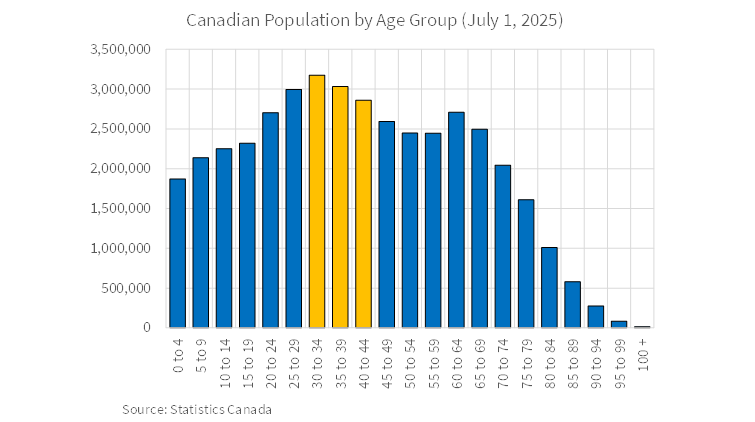

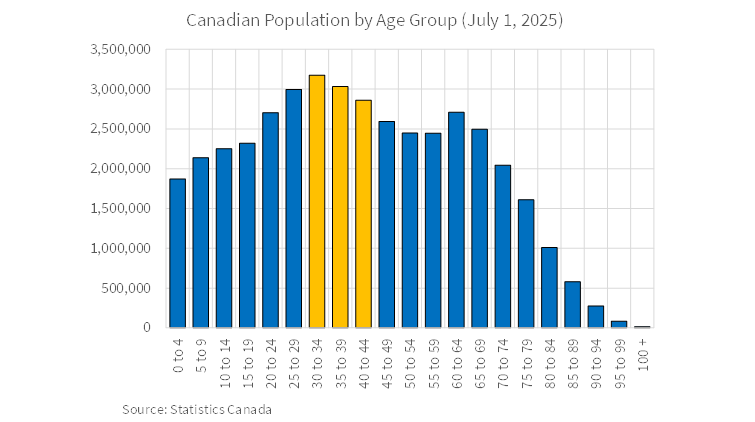

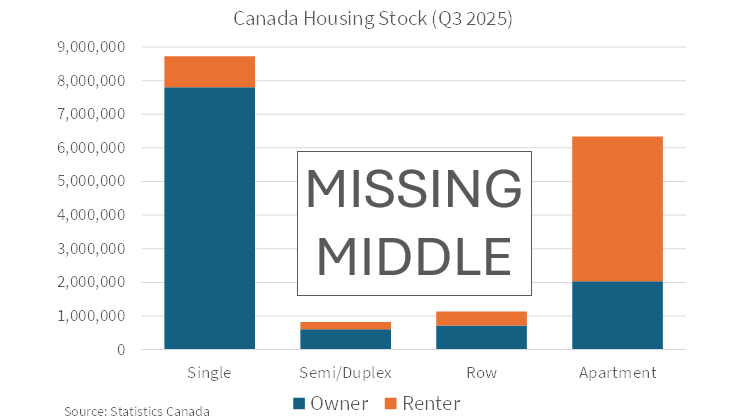

The “Missing Middle” and Ottawa’s Supply Challenge

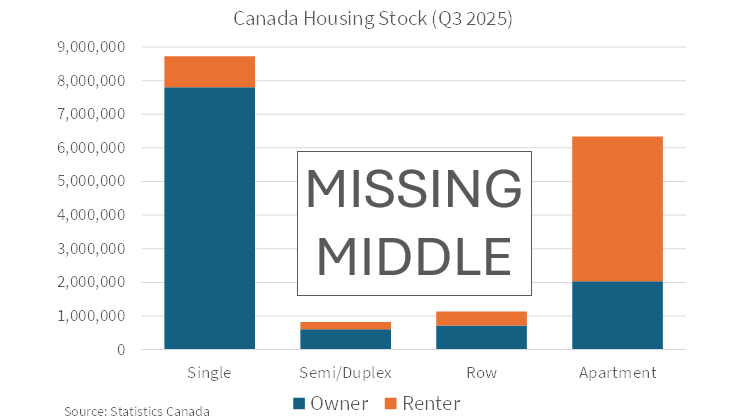

Another major theme in the CREA update is the ongoing shortage of “missing middle” housing — things like townhomes, duplexes, and smaller multi-unit properties. These are often the most practical options for first-time buyers, growing families, and downsizers. Unfortunately, they’re also in short supply, especially in Ottawa (Figure 3).

Figure 3: Housing stock by dwelling type highlighting the “missing middle” (CREA Housing Update, Jan 2026).

This supply gap helps explain why certain segments of Ottawa’s market remain competitive, even when overall sales activity slows. When demand consistently outweighs supply in these categories, prices tend to stay firm.

——————————————————————————————————————————-

Public Service Employment and Local Confidence

CREA also points to federal budget projections showing 16,000 job reductions over three years and 41,000 over five years, starting in 2024. Importantly, many of these reductions are happening quietly through retirements and attrition rather than sudden layoffs.

For Ottawa, that distinction matters. Gradual workforce changes typically have a much softer impact on housing demand than abrupt job losses. It’s one of the reasons our local market has remained relatively stable compared to other parts of the country.

——————————————————————————————————————————-

Ottawa’s Market: Resilient, But Selective

When you look specifically at Ottawa’s new residential construction and resale activity, the picture that emerges is a market that’s functioning well — just more selective. Homes that are well priced and in desirable neighbourhoods are still selling. Properties that miss the mark on price, condition, or presentation are taking longer.

This isn’t a market driven by panic or hype. It’s one that rewards preparation, good advice, and a clear understanding of local conditions.

——————————————————————————————————————————-

Final Thoughts

CREA’s January 2026 update reinforces what many Ottawa buyers and sellers are already feeling. Demand hasn’t disappeared. Interest rates are relatively stable. Supply challenges are still very real. And while uncertainty exists, Ottawa’s housing market continues to operate with balance and resilience.

As always, the most important piece is understanding how these broader trends apply to your situation. That’s where strategy, timing, and local insight really matter.

Sources

Canadian Real Estate Association (CREA), Housing Update Presentation, January 16, 2026. Data and charts referenced from CREA presentation slides, including Bank of Canada policy commentary and Abacus Data on homeownership demand.

Posted on: February 20th, 2025 by Chris Scott

When it comes to selling a home, first impressions are everything. That’s why staging is one of the most powerful tools in our real estate playbook. A perfectly staged home doesn’t just look good—it tells a story, invites buyers in, and helps them envision their future in the space.

We recently had the opportunity to work on a condo that was completely vacant when we first listed it. While it had a great space and natural light, it lacked the warmth and personality that buyers are drawn to. That’s when we called in our expert stager, and the results were nothing short of remarkable.

Before: A Blank Canvas

When we first stepped into the condo, it was completely empty—just walls, floors, and windows. While some buyers can see past that, many struggle to picture how furniture will fit, how spaces flow, and how it will feel to live there. Empty rooms can also make a home feel cold and uninviting, making it harder for buyers to form an emotional connection.

After: A Standout Listing

The difference was night and day. Once staged, the condo no longer felt like an empty space—it felt like a dream home. The transformation not only enhanced its visual appeal but also made the listing photos pop, attracting more online views and interest from buyers.

And the best part? It worked. The staged condo quickly stood out in the market, leading to more showings and strong interest from potential buyers.

Why Staging Matters

Staging isn’t just about making a home look pretty—it’s about creating a connection. It helps buyers see the potential of a space and imagine themselves living there. In a competitive market, it can be the difference between a listing that lingers and one that sells quickly.

If you’re thinking about selling your home, don’t underestimate the power of staging. Whether it’s a condo, townhome, or single-family house, we have the resources and expertise to make your home shine.

Curious about what staging can do for your home? Let’s chat and make your property stand out!