Posts Tagged ‘Ottawa Housing Market’

Posted on: December 10th, 2021 by Chris Scott

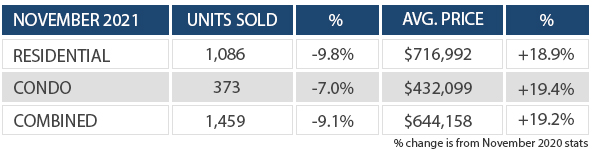

If we compare this past November’s real estate market to November 2020, we again see that it is skewed as the Spring market was pushed into Fall in 2020 due to the pandemic lockdown. In comparison, November’s unit sales tracked 14% higher than 2019 (1,284), a more relevant base year. This is good to keep in mind when taking in the most recent market statistics.

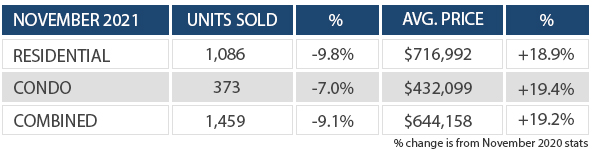

1,459 residential properties were sold in November compared with 1,605 in November 2020, a decrease of 9%. November’s sales included 1,086 in the residential-property class, down 10% from a year ago, and 373 in the condominium-property category, a decrease of 7% from November 2020. The five-year average for total unit sales in November is 1,348.

Average sale prices for November are for a residential-class property $716,992, an increase of 19% from a year ago, and the average sale price for a condominium-class property was $432,099, an increase of 19% from 2020. With year-to-date average sale prices at $719,956 for residential and $420,762 for condominiums, these values represent a 24% and 16% increase over 2020, respectively.

Even though there were significant increases in average prices over November 2020, month-to-month price accelerations have tapered off slightly, with average prices for residential units on par with this past October’s and condo average prices increasing by 7%. For buyers, this is a much better situation than the monthly price escalations the first quarter of 2021 had shown us.

Ottawa is still sitting at one month’s supply for inventory, still signaling a seller’s market. Supply constraints will continue to affect prices until more inventory is made available.

As always if you have any questions or would like to know about any activity in your neighbourhood feel free to reach out.

Posted on: November 12th, 2021 by Chris Scott

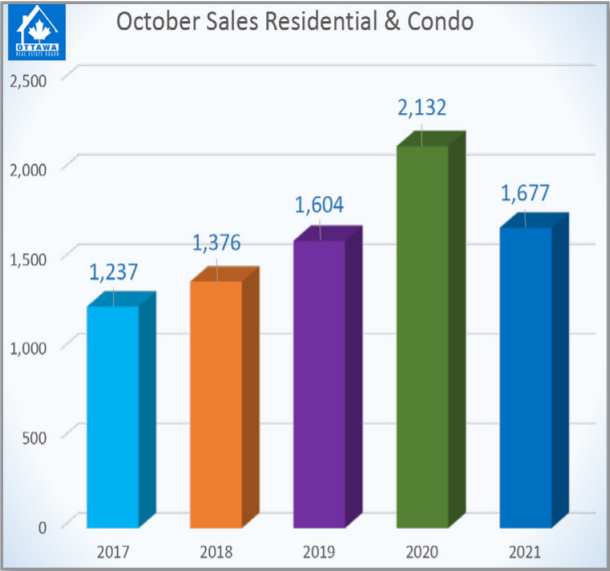

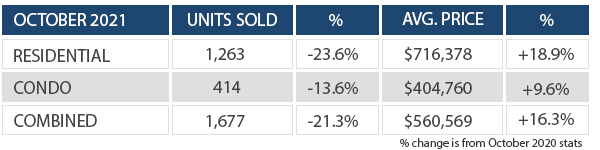

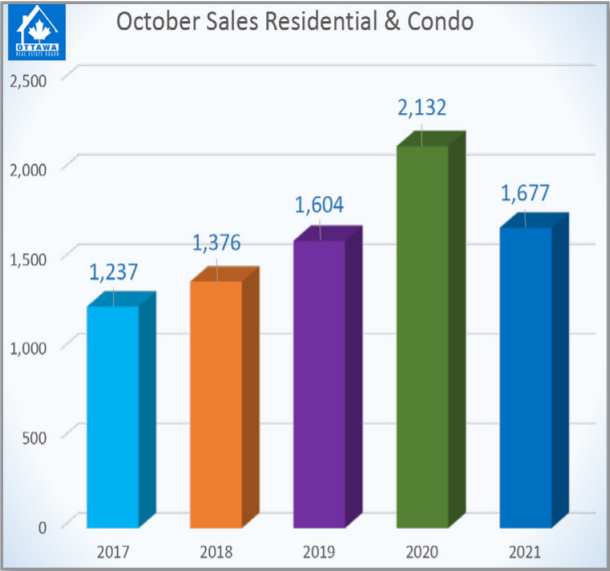

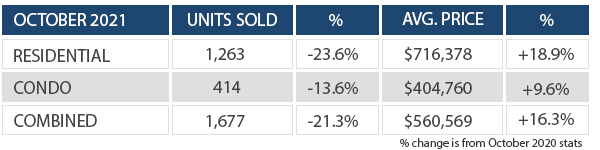

October’s market was a bit more normal, in terms of units sold, given the regular Fall season, it was active, busy, and things seem to be stabilizing. Compared with 2020, the statistics are showing a decrease in units sold, which is still reflective of the shift of the 2020 Spring market to Fall 2020, which was due to the Spring 2020 lockdown.

Inventory is remaining at a one-months supply for residential and a 1.2 months supply for condos, which is why there is still pressure on prices. With this amount of inventory, it is still considered a sellers market. The only way to find balance in this market is to increase available housing stock.

Low inventory and a lack of suitable housing options are not giving buyers who want to move up the property ladder or those that want to downsize a place to go. Because of this, properties are not being freed up for entry-level homebuyers.

Another piece of the puzzle is rental properties, Ottawa Real Estate Board has noticed a substantial increase in the number of rental transactions. This could suggest that some properties have been purchased or held on to for investment purposes. This active rental market may be another contributing factor as to why there aren’t more properties coming onto the market for sale.

All of these factors put together equal a tough market for buyers to navigate.

As always if you have any questions or are interested in knowing more about activity in your neighbourhood, feel free to give us a call.

Posted on: October 13th, 2021 by Chris Scott

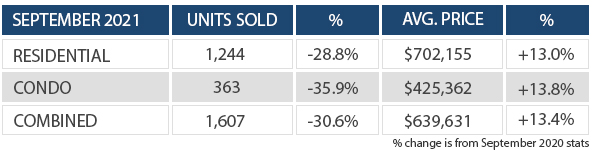

The Ottawa Real Estate Market seems to be back to a typical September market. It started off slowly due to the long weekend and back to school, but it picked up again near the end of the month.

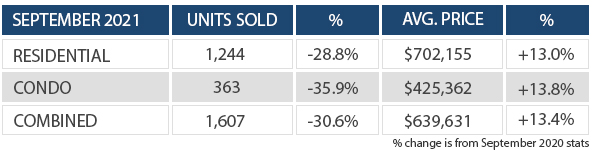

Last month, 1,607 residential properties were sold, compared with 2,314 in September 2020, a decrease of 31%. September’s sales included 1,244 in the residential-property class, down 29% from a year ago, and 363 in the condominium-property category, a decrease of 36% from September 2020. The five-year average for total unit sales in September is 1,648.

Statistics are showing a considerable year-over-year decrease in transactions, due to the lockdown in Spring of 2020, the peak of the market shifted from the Spring to the Summer and Fall months. For some perspective, the number of transactions in September was 4% higher than in 2019 (1,547) and 16% higher than 2018 (1,387).

September’s average sale price for a condominium-class property was $425,362, an increase of 14% from last year, while the average sale price for a residential-class property was $702,155, an increase of 13% from a year ago. With year-to-date average sale prices at $720,492 for residential and $421,062 for condominiums, these values represent a 25% and 17% increase over 2020, respectively.

Inventory is still sitting at just over one month’s supply of housing stock at this time. There were 2,252 new listings in September, an increase of 216 units over August; however, the number still falls beneath the five-year average and is much lower than this month in September 2020 (2,906). Price escalations are inevitable given the supply challenges we have been experiencing for several years now combined with the unrelenting high demand.

As always if you are interested to know more about the market, or if you would like to know what a home in your area sold for, please get in touch!

Posted on: September 14th, 2021 by Chris Scott

If anyone is interested. Here are some random thoughts on a few things real estate and otherwise.

Capital Gains on Primary Residences?

This is not going to happen. I have been asked this a few times this past month. Governments want to get elected again and having 100% of homeowners against them will not help their chances. Could they increase the capital gains on investment properties or flipping. I believe that could be the case. But they will never come after our gains on our primary residence.

Changing Market

Sellers really need to start having better expectations of what they are going to get in this market. I recently priced out a house that may have gotten $1 million as a sale price in April. Right now, I’m seeing that it may be more like 925 to 950k. The seller seemed very disappointed at this number. This is a house that would’ve been worth 775 last year. I would still say it was a very good investment we are just not selling at the all-time high right now.

The Power of Staging

One of the hardest things to do as a real estate consultant is showing people the value of staging. It is hard because there is no clear return on investment. What I mean by that is when you do the staging there’s no set amount that you’re going to get back by doing it. It is all based on my experience as a realtor and seeing firsthand that home preparation is the number one way to increase what a client will get for their house. I spent $3000 staging my own house and Colin from our team spent over $2000 staging his home for sale. There is a reason we invested in this process.

Pandemic Fatigue

Anyone else feel that they need the world to go back to normal ASAP? In many ways, this Fall is hopefully going to bring some normalcy with kids back in school. For me as a business owner, team leader, realtor, friend, and most importantly father and husband it has been so difficult to feel like I am succeeding at any one of these important tasks. I feel like I’m doing OK but just not flourishing if you know what I mean. In many ways, I need to relearn the good habits that I had in place before covid started. Also, anyone else dressing a lot more casually? Lulu dress pants are now my go-to!

Current Favourites

The best snack mix going right now is the Cajun mix at Farm Boy, another favorite is Farm Boy’s chocolate-covered pretzels. A close second are Miss Vickie’s Spicy Dill Pickle chips. Anyone one else developing a snacking habit? We have snack-a-palooza’s at least twice a week.

Recent Reads

Right now, I am reading Greenlights by Mathew McConaughey. Good life story. It is funny and interesting. Alright, Alright, Alright!

Also, reading The Song of Achilles. So far so good.

Best of TV

Right now the best thing on TV are the Blue Jays! Loving the streak and playoff push.

Posted on: September 14th, 2021 by Chris Scott

This Fall will be an interesting real estate market to monitor in Ottawa. I think it will be very active but prices will continue to stabilize. I am already feeling a shift. Showing activity is down and buyers are not quite as willing to pay a premium price on some listings. They are starting to get more patient or are just burnt out from the year that was. It is important to understand that buying a home within set criteria is no easy feat right now.

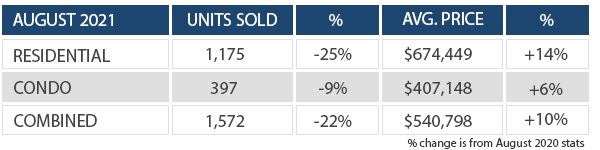

August has brought us even more stabilization to the market and offering a bit more of an increase in housing stock at 1.5 months of inventory. This is still categorized as a seller’s market, as a balanced market is defined as 4-6.5 months’ worth of inventory. August’s inventory is approximately 5-6% higher than last year for both residential and condominium property classes.

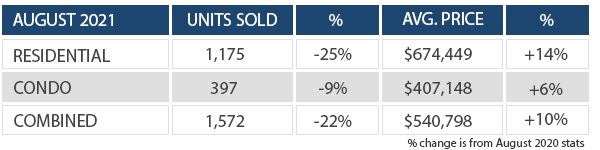

The latest stats from the Ottawa Real Estate Board show a sharp decrease in sales compared to last year’s numbers due to the first wave lockdown in Spring 2020, which shifted 2020’s usual Spring market to the Summer and Fall months. However, August 2021 numbers are on par with August 2017 and 2018.

Last month there were 1,175 residential properties sold, compare that to 1,568 in August 2020, a decrease of 25%. Condominium-property class sales were 397, a decrease of 9% from August 2020. The five-year average for total unit sales in August is 1,684.

Year-to-date resales are at 14,728 and are 24% higher than this period in 2020, indicating Ottawa’s market is currently in another strong year.

August’s average sale price for a condominium-class property was $407,148, an increase of 6% from last year, while the average sale price for a residential-class property was $674,449, an increase of 14% from a year ago.

With year-to-date average sale prices at $722,526 for residential and $420,654 for condominiums, these values represent a 27% and 18% increase over 2020, respectively.

“Supply continues to remain scarce, and that is the driving factor behind these price increases. New listings were down 400 units from July and 500 units from last August and below the 5-year average for the first time this year since February.” states Ottawa Real Estate Board President Debra Wright.

“We are pleased to see that housing affordability and the supply shortage have been a predominant part of election conversations and federal party platform pledges – which is a step in the right direction. We look forward to the collaboration between municipal, provincial, and federal governments to establish measures which will effectively address these fundamental barriers to homeownership for all Canadians who desire to own a home.” Debra adds.

As always if you are interested to know more about the market, or if you would like to know what a home in your area sold for, please get in touch!

Posted on: August 10th, 2021 by Chris Scott

The Ottawa real estate market has continued to stabilize. The record rise in prices seems to be trailing off. This is welcome news for buyers. You can see this in the numbers that were released from the Ottawa Real Estate Board.

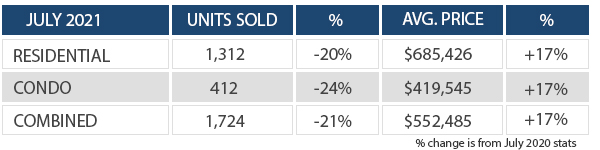

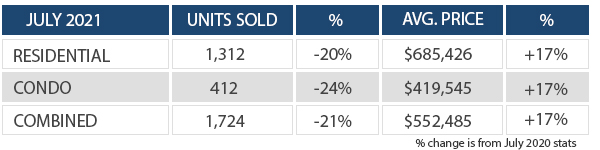

Last month there were 1,312 residential properties sold, compare that to 2,183 in July 2020 and there is a decrease of 20%. Condo properties sold numbered 412, down 24% from this time last year. Now last year we were coming out of a lockdown in Spring so those numbers are a bit inflated because the Spring market was pushed more to the summer months. Month over month prices are down for the 3rd consecutive month, although still nice gains year over year of 30% on residential class property and 20% on the condo class.

The frenzy that was a few months ago has settled. Instead of every property going into multiples it is now just the cream of the crop that attract the frenzy. Make no mistake this is still a seller’s market and some houses are still getting double digit offers. It is just not the norm. Sellers need to have realistic expectations of the current market conditions. Many sellers right now are coming in too high and are sitting on the market. They want to list high and get the bidding war. You can’t have your cake and eat it too! I think a hybrid approach is working best.

Housing stock is increasing with residential inventory up 19% and condominium supply up 23%, higher than 2020.

There were fewer listings in July vs. June, however, the number of properties that entered the market in July is over the five-year-average. This along with seeing housing prices stabilize, it seems we are headed towards a more balanced market in the months ahead.

As always if you are interested in knowing what is going on in your neighbourhood or have any questions, please feel free to reach out.

Posted on: July 13th, 2021 by Chris Scott

The talk of Ottawa the past few weeks has been the cooling real estate market. I just wanted to add some perspective on this. The market is most certainly changing but the first quarter of this year was so hot that we may never see that type of inventory shortage again in our lifetime. It is just not the same offer frenzy that we were used to. Buyers are spreading their offers around on different properties. Hopefully this will lead to more balance in the market.

The market is not the same as what it was and that is ok. It is still very much a seller’s market right now. Prices have stabilized and for the most part, sellers are still trying to achieve prices that comparable houses sold for a few months ago. In some areas that is still very achievable and in other cases those numbers are now out of reach.

Where do we go from here?

Prices have certainly stabilized over the past few months. Buyers still seem to be able and willing to pay the premium prices that sellers are demanding. There are fewer offers on properties but the pricing strategy has really changed. Sellers in many cases are now pricing at the mid to high end of the market. So instead of pricing a home 100k less than what they expect they may price it 20-50k less and if on offer date they don’t get an offer they likely will increase the price to match their expectations. Some sellers are still going way under their desired price and others are pricing right at the most recent comparable. This has created a very complicated marketplace. With so many strategies out there it is important to lean on your Realtors experience to help navigate you through it.

With year-to-date average sale prices at $734,357 for residential and $422,734 for condominiums, these values represent a 33 per cent and 20 percent increase over 2020, respectively. Pretty incredible numbers really.

Every house is unique. If you want to know what’s happening in your area please feel free to reach out.

Posted on: June 15th, 2021 by Chris Scott

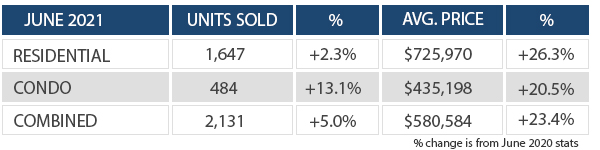

The market in Ottawa right now seems to be in transition. Homes are still selling at record prices but the upward trend in prices month over month seems to be leveling out. The first quarter of this year saw unprecedented price growth. That type of rapid appreciation can happen only over a shorter period of time. Now sellers are pricing at higher numbers to start and still hoping, and in some cases expecting buyers to bid way over the asking price. In many cases that is just not happening. Some sellers are not getting any offers on their offer date and transitioning to a more traditional offer anytime approach should they not get an offer. In some cases, they are raising their price too. List prices don’t mean much right now. If the property is priced right and is attractive to buyers then of course they can still generate many offers on the house. In general, most sellers are still getting multiple offers, but where it was 8-12 offers or more in April, now it is more like 3-5 offers.

There are also fewer viewings, but seller’s prices are also generally higher to start with. It all makes a very confusing market because there are so many strategies at play. I look forward to a time in the future where the price listed is the price the seller expects to sell for. It would make our market a whole lot easier to navigate for both buyers and sellers.

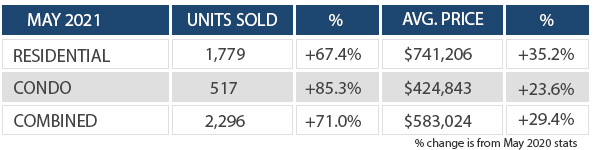

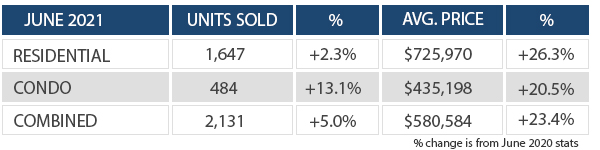

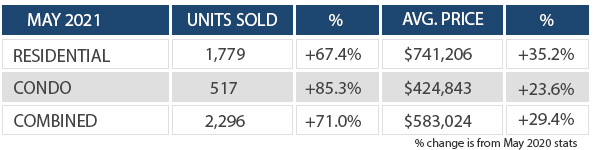

2,296 residential properties were sold in May, compared with 1,342 in May 2020, an increase of 71 per cent. May’s sales included 1,779 in the residential-property class, up 67 per cent from a year ago, and 517 in the condominium-property category, an increase of 85 per cent from May 2020. The five-year average for total unit sales in May is 2,123. This is an important number because last May we were in a stricter lockdown and the numbers are skewed.

I predict the market to remain a sellers market for the remainder of the year, however prices are leveling out and there will be more options for desperate buyers out there. Every house and neighbourhood are different.

If you ever want to know about the activity in your neighbourhood or have any questions at all, please reach out to our team.

Posted on: May 13th, 2021 by Chris Scott

It is hard to believe that Ottawa has had lockdowns in April of last year and this year! This of course is going to have an impact on real estate sales. We are an essential service and I have had very few clients suspend their search due to the lockdown measures. The market is red hot of course but prices seem to be all over the place depending on the strategy the sellers are using. It is like wheel of fortune out there. You can list low and win a big number on offer day. If you list over actual retail value than your house may not get offers and you will be in a weird limbo that some sellers find themselves in. Finding the sweet spot price wise while not going over or too far under is what you need to do. Think of your Realtor as Bob Barker guiding you to the right price so you can play in the showcase showdown. Pricing has never been more important. Price too high and you could actually get far less for your property. It is not a great pricing system right now in the Ottawa real estate market and I hope it gets corrected. I long for the days of having standard prices where a list price actually means something. Until that happens we need to spin the wheel and play the game.

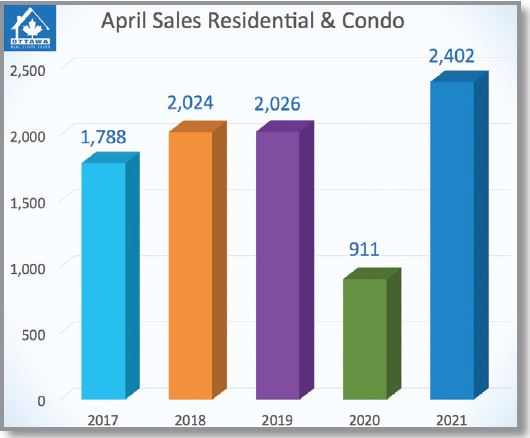

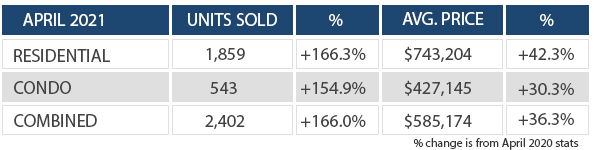

Stats for this month, which show year over year comparisons with 2020 are very skewed due to the State of Emergency declared in April 2020. April 2021 started off strong, however ended up tapering off due to the stricter lockdown order announcement that came mid-month.

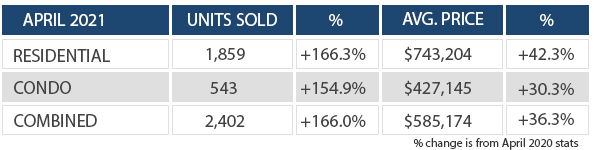

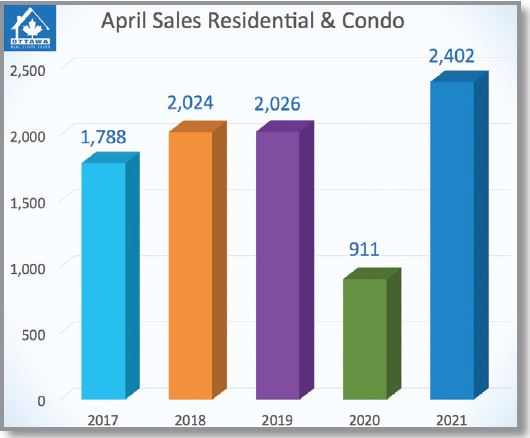

We have had 166 per cent more residential sales this April versus this time last year and the average price for a residential property has seen an increase to $743,204, a 42 per cent increase from April 2020. Condos, also seeing an increase of 154 per cent in sales and average sale prices up 30 per cent at $427,145 compared to this time last year.

To show a true comparison 2,402 residential properties were sold in April, we can look at the 5 year average for April The five-year average for total unit sales in April is 1,830. That represents a sizable increase in sales.

Posted on: April 16th, 2021 by Chris Scott

It has been so interesting observing market trends over the past few weeks. There are some homes going way more than what they should be selling for while other ones are not getting offers on their pre-arrange offer date. I think many sellers are starting to list at the higher end of the market but that is not necessarily the right strategy. Buyers are conditioned to pay much more than asking and if they see a price at the high end of the market they assume they would have to pay way more to secure it. Often times those houses end up selling for less than they should be. The showing experience is also becoming more and more important. The well staged and presented homes are the ones going for the crazy prices. These are the ones that are capturing buyers hearts and getting them emotionally committed to the houses and subsequent bids.

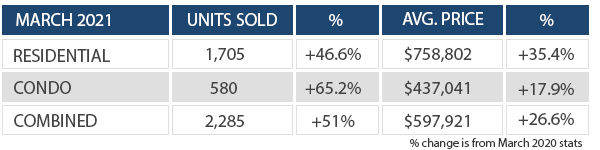

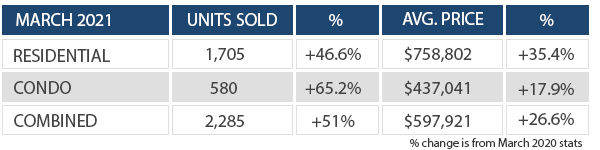

We have had 47 per cent more residential sales this March versus this time last year and the average price for a residential property has skyrocketed up to $758,802, a 35 per cent increase from March 2020. This trend is also continuing with condos, seeing an increase of 65 per cent in sales and average sale prices up 18 per cent at $437,041 compared to this time last year.

The pandemic has brought us a once in a lifetime type of real estate market. The challenge I see moving forward is the supply issue could be here with us for the foreseeable future. Our city is growing and everyone wants to have home ownership. Why would you not when you see the type of equity homeowners are building. I do think things will get a bit easier in the next few months for buyers. In the past week I have seen more townhomes come to market than at any other time in the last year. I think townhome owners are seeing the relatively small gap between what their houses would sell for and getting into a larger single home.

As always feel free to reach out to me, or any member of our team if you would like to know what your home is worth or if you are interested in recent neighbourhood activity.

Stay safe and take care!