OTTAWA MARKET UPDATE: APRIL 2023

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. This series showcases statistics for the 5 largest urban neighbourhoods in Ottawa.

As Ottawa is such a spread-out city it’s great to see the variances from area to area. All of these statistics are based on MLS OREB sales from January 1, 2022, to April 30, 2022, over January 1, 2023, to April 30, 2023.

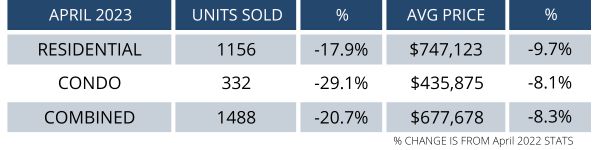

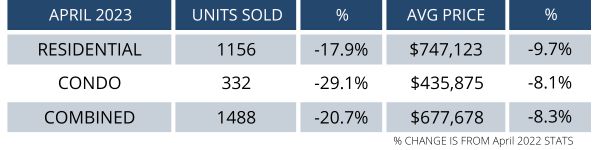

Interesting times right now in the Ottawa Real Estate market. The spring surge seems to be in full swing and will be helped by record temperatures this weekend. Snow is gone and many buyers are re-engaging in their searches. Here is a snapshot of what is happening right now:

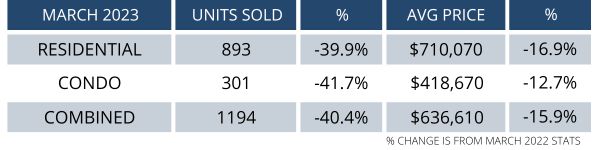

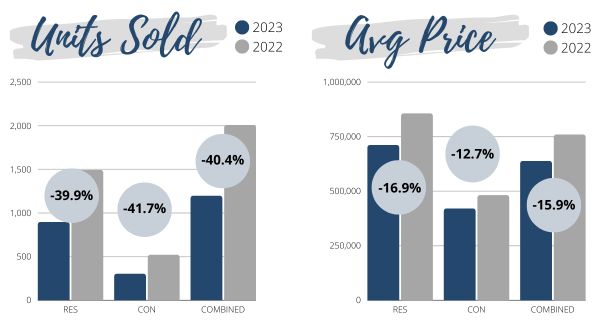

In March, members of the Ottawa Real Estate Board (OREB) sold 1,194 residential properties through the Board’s Multiple Listing Service® (MLS®) System. This represents a decrease of 40% compared to March 2022, with 893 sales in the freehold-property class (down 40%) and 301 sales in the condominium-property category (down 42%). However, March sales transactions increased by 40% compared to February. The five-year average for total unit sales in March is 1,698.

OREB President Ken Dekker noted that the recent rise in transactions is a sign of typical spring activity, even though it is behind the pandemic peaks of 2022. As spring unfolds, a clearer picture of Ottawa’s balanced market state will emerge. The way I see it is, it may be another seller’s market this year with less than 3 months’ worth of inventory.

The average sale price for a freehold-class property in March was $710,070, down 17% from 2022 but up 0.2% from February 2023. Average freehold prices have risen by approximately 8% during Q1 2023 compared to December 2022’s market low. The average sale price for a condominium-class property was $418,670, down 13% from a year ago but up 2% from February 2023. Year-to-date average sale prices for freehold-class properties and condominium-class properties were $701,837 and $414,698, respectively, representing a 16% and 11% decrease from 2022.

OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Every neighbourhood is different. If you want to know what’s happening in your area please feel free to get in touch.

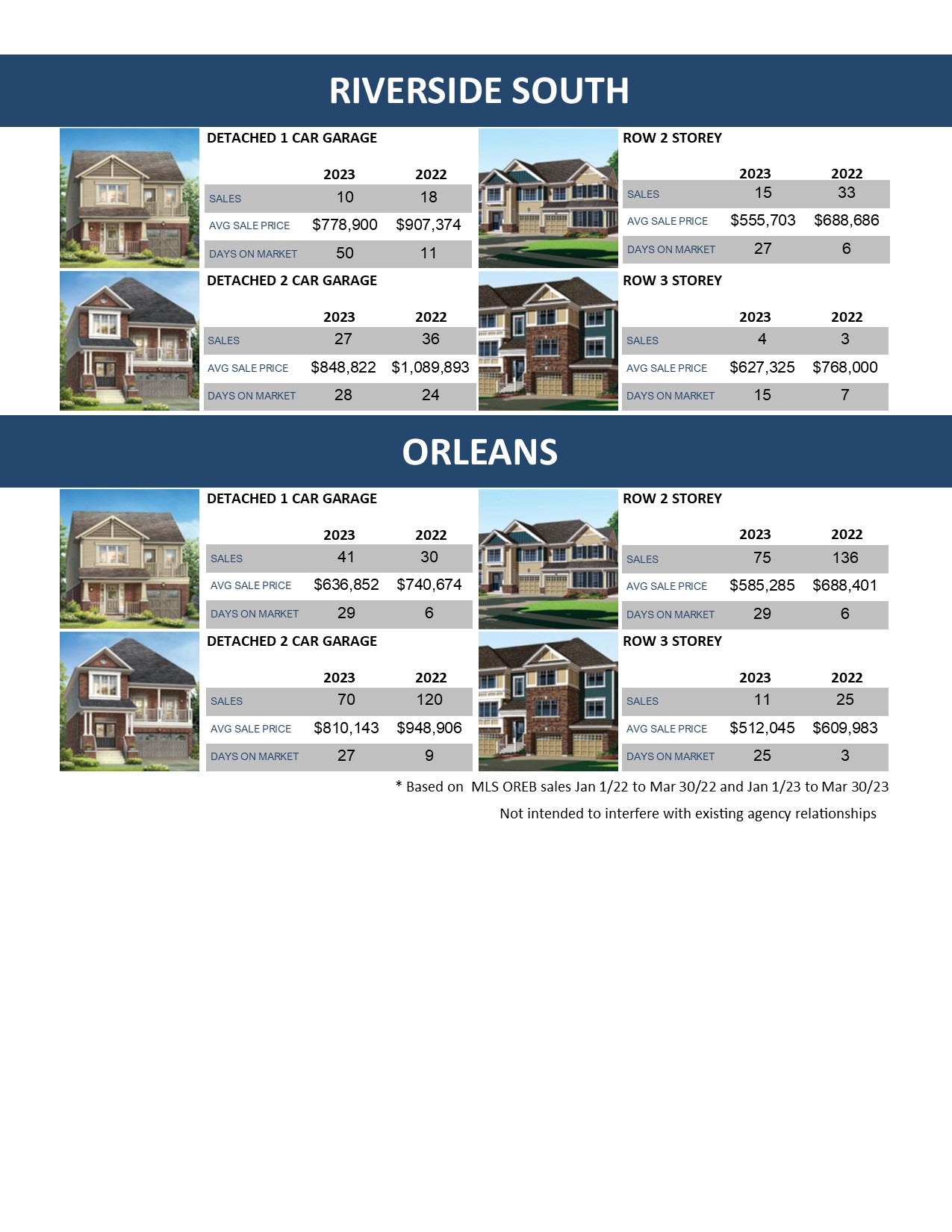

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. This series showcases statistics for the 5 largest urban neighbourhoods in Ottawa.

As Ottawa is such a spread-out city it’s great to see the variances from area to area. All of these statistics are based on MLS OREB sales from January 1, 2022, to March 30, 2022, over January 1, 2023, to March 30, 2023.

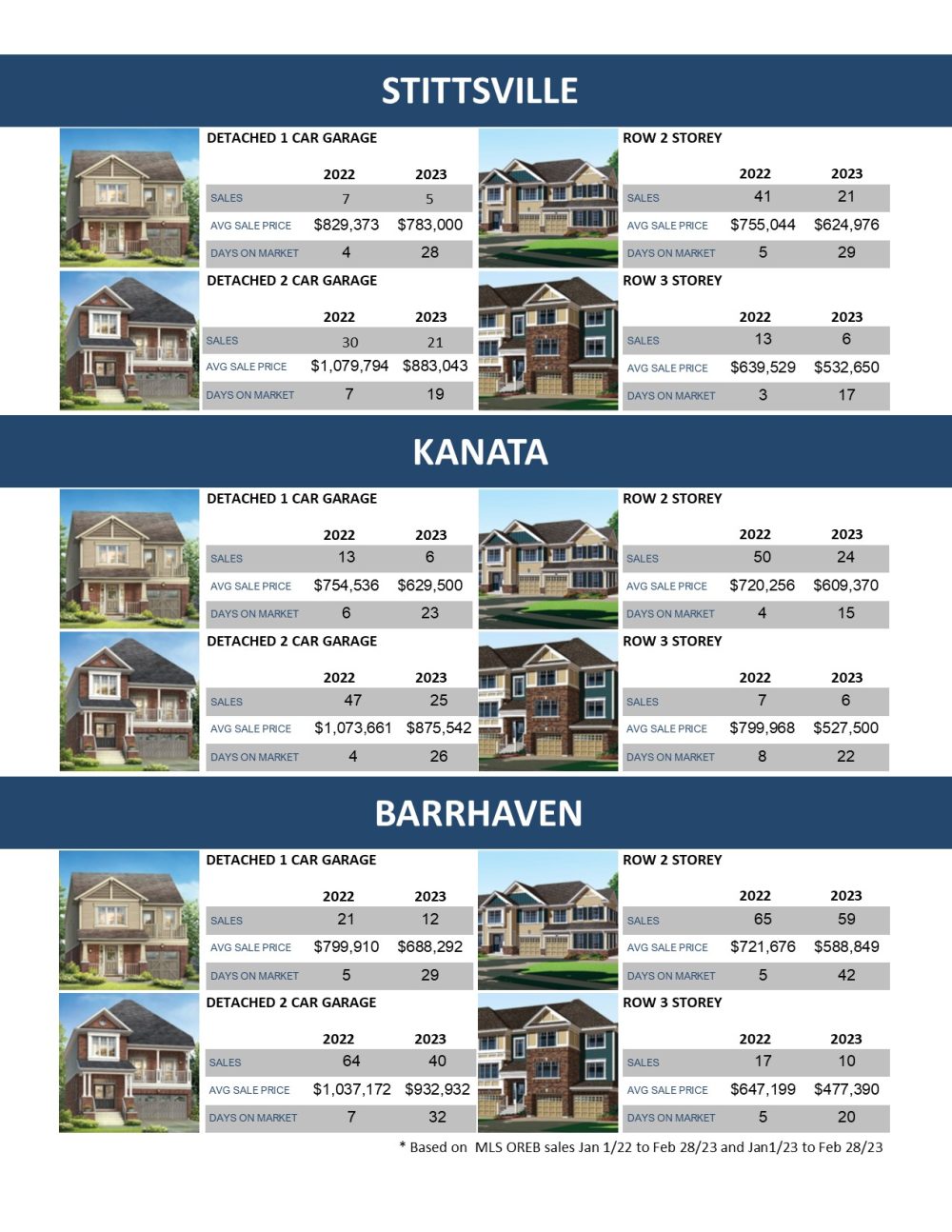

The Stittsville real estate market has had an incredible roller coaster ride of prices since the pandemic began in 2020. With prices peaking in early 2022. Since that time Bank of Canada’s measures to fight inflation through interest rate hikes has had a significant impact on house prices in our community. For this report, we are comparing prices from the first quarter of this year against the first quarter of last. Here are the results of this comparison.

What jumps out to me is that both detached 2-car garage homes and row units declined the most in value. Stittsville remains more expensive than all the other major suburbs in Ottawa. It is continually on the list of my relocating clients.

I predict that the market will get better as I’m already seeing lower inventory and the return of multiple offers in some cases. Buyers who are well qualified, but maybe have been on the sidelines since the declines have re-entered the market as they may feel like house prices have bottomed out. The challenge these buyers are facing is that inventory levels are still low by historical standards. Not quite where they were last year, of course, but much lower than anyone is talking about. The wildcard is if the Bank of Canada keeps their current rate steady and we can see some stabilization back in the market. I have actually heard rumours that some banks may even reduce their current rates in the weeks ahead. If that happens we will have a busy Spring and Summer market.

It is very important for sellers to create an experience for their prospective buyers to get the most amount of money possible. What that looks like to me is having the house staged, marketed properly, and easy to buy. Our team specializes in selling in the Stittsville area and can make sure you get the absolute most money you can for your home in the least amount of time. If you are curious as to what your home is worth please feel free to reach out.

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. We are bringing you specific real estate market statistics for Stittsville. The market is different depending on what area of Ottawa you look at. This gives you a specific snapshot of the first-quarter statistics for 2023 in Stittsville.

All of these statistics are based on MLS OREB sales from January 1, 2022, to March 30, 2022, over January 1, 2023, to March 30, 2023.

When purchasing a home it is important to know what the extra costs will be. The projections below are an estimate of expenses involved in a typical real estate purchase. Not all of these costs* will apply in all circumstances.

| LEGAL/ RELATED FEES | INSPECTION COSTS | |||

| Lawyer Fee | $900-$1100 | Home Inspection | $500-$600 | |

| Legal Disbursements | $600-$800 | Status Certificate | $100 | |

| Prepaid Taxes or Utility Bills | To be determined | Septic Inspection | $500 | |

| Title Insurance | $270 | Water Inspection | $450 | |

| MOVING COSTS | ||||

| Moving Company | $600-$4000 | |||

| Utility hook ups etc. | To be determined | |||

| Change of locks | $100 | |||

| PURCHASE PRICE | LAND TRANSFER TAX | LOAN-TO-VALUE RATIO | PREMIUM RATE | |

| $300,000 | $2,975 | Up to and including 65% | 0.60% | |

| $400,000 | $4,475 | Up to and including 75% | 1.70% | |

| $500,000 | $6,475 | Up to and including 80% | 2.40% | |

| $600,000 | $8,475 | Up to and including 85% | 2.80% | |

| $700,000 | $10,475 | Up to and including 90% | 3.10% | |

| $800,000 | $12,475 | Up to and including 95% | 4.00% Traditional Down Payment | |

| $900,000 | $14,475 | 4.50% Non Traditional Down Payment | ||

| $1,000,000 | $16,475 | |||

| $1,100,000 | $18,475 | |||

| $1,200,000 | $20,475 | |||

| $1,300,000 | $22,475 |

*Please note: these costs are merely an estimate and are only provided as a ballpark estimate of what to expect when purchasing a home.

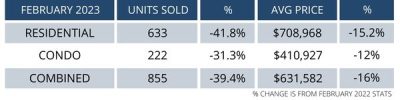

When looking back on last year, it’s important to know that February 2022 represented the absolute peak of our local real estate market. We had the perfect storm of low-interest rates, high demand and extremely low inventory which of course caused prices to spike. This year our market is in a very different situation. We are very much a balanced market that can stay there if interest rates stay the course. If they rise we will see us move toward a buyers market.

Our current market is a much more reasonable place to buy and sell real estate. From what I’m feeling on the ground is that buyers are starting not only to look at properties more but are also engaging and making offers. Just this last week I noticed a few listings that have been on the market forever finally sell. I think this is indicative of more buyers feeling comfortable that we are indeed at the bottom of this market cycle.

There were 855 residential properties were sold in February 2023 compared with 1,411 in February 2022, a decrease of 39%. February’s sales included 633 in the freehold-property class, down 42% from a year ago, and 222 in the condominium-property category, a decrease of 31% from February 2022. The five-year average for total unit sales in February is 1,157.

If the Bank of Canada holds interest rates steady, buyers will have more certainty to work with as we head into the spring market.

The average sale price for a freehold-class property in February was $708,968, a decrease of 15% from 2022. However, it marks a 5% increase over January 2023. The average price increase for freeholds over January could be an indicator that buyers have normalized to the current interest rates. And perhaps, it’s a glimmer of more activity to come in the months ahead.”

The average sale price for a condominium-class property was $410,927, decreasing 12% from a year ago.

With year-to-date average sale prices at $695,086 for freeholds and $411,449 for condos, these values represent a 14% decrease over 2022 for freehold-class properties and a 10% decrease for condominium-class properties.

Months of Inventory for the freehold-class properties has increased to 2.8 months from 0.7 months in February 2022.

Months of Inventory for condominium-class properties has increased to 2.5 months from 0.7 months in February 2022.

February’s new listings (1,366) were 22% lower than February 2022 (1,762) and up 3% from January 2023 (1,323). The 5-year average for new listings in February is 1,632.

Days on market (DOM) for freeholds decreased from 43 to 37 days and 47 to 43 days for condos compared to last month.

Every neighbourhood in Ottawa is different and will have trends that are unique to your area. If you want to know what your home is worth please feel free to get in touch with our team. We are always happy to help.

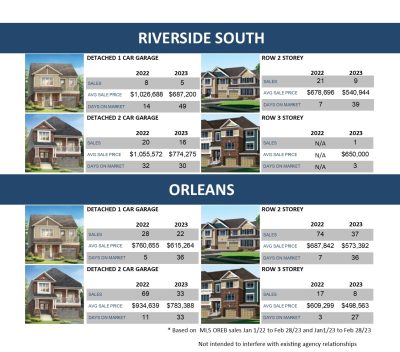

Here is the most recent installment of our new monthly value-added feature, the Suburban Statistics Series. This series showcases statistics for the 5 largest urban neighbourhoods in Ottawa.

As Ottawa is such a spread-out city it’s great to see the variances from area to area. All of these statistics are based on MLS OREB sales from January 1, 2022, to February 28, 2022, over January 1, 2023, to February 28, 2023.

Buying a home can feel overwhelming for many. That’s why it’s so important to get the guidance of a great Ottawa Realtor. Our team can certainly help you navigate this stressful time and help make it enjoyable and stress-free.

There are so many things to take into consideration when buying a house. Here are a few of the main things buyers need to think about as they search for a home.

Resale value: Lastly, it is important to consider the resale value of the house. You never know when you might need to sell the house, so it is important to think about its long-term value. Look at the real estate market trends in the area and think about the potential for the house to appreciate over time. As an Ottawa Realtor we are certainly going to help you in this regard. We know the

Resale value: Lastly, it is important to consider the resale value of the house. You never know when you might need to sell the house, so it is important to think about its long-term value. Look at the real estate market trends in the area and think about the potential for the house to appreciate over time. As an Ottawa Realtor we are certainly going to help you in this regard. We know the

With interest rates potentially holding steady the Ottawa market may be on the verge of heating up. Buyers are still super cautious but there are plenty of well-qualified buyers in the marketplace right now. Judging by full open houses and good showing activity. The challenge is that no buyer wants to make a large purchase now only to see things further reduced in 6 months from now. So many are just waiting. The ones that are making offers may just be rewarded. Warren Buffet always said to buy while others are weary. The thing about real estate is that we know we are way off the peak and the chances are that in the next few years we will be up and over the earlier highs of 2022.

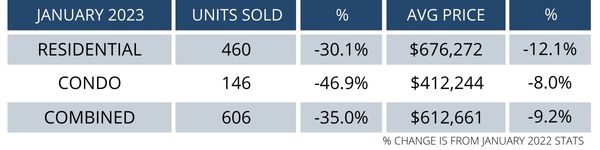

If I was to sum up our market in one word it would be cautious. The numbers reflect that. The price of a residential home is down 12% from January 2022, down to $676,272, condo pricing is down as well, 8% from January 2022, sitting at $412,244. In terms of units they are also down from January 2022, 30% down for residential and 46.9% down for condo units sold.

As always please feel free to reach out to our team, if you have any questions, or if you would like to know what is happening in your neighbourhood!